Back in 2011 when I first joined Launch Capital, we started a project to see if we could find untapped markets that would prove to be huge markets and produce huge wins but find them early enough so that we could get ahead of the wave and get our bet(s) in before everyone else figured it out.

While we are still working on ways to uncover untapped markets, one of the interesting things we have discovered is that when a startup appears heralding a new sector, it often is the only entrant for a long time, often for years. Then there is a trickle, and an exponential rise to flood.

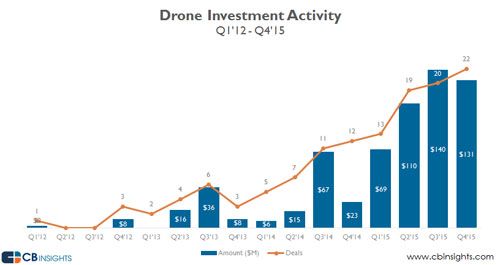

Take the Drone sector, for example. One analog for “hot-ness” of a sector is the amount of dollars investing into it. Here is a graph of Drone sector financing dollars from Q1 2012 to Q4 2015:

Source: CBInsights

Who was that lone drone startup who got funding back in Q1 2012? 3D Robotics, the very first funded drone company, co-founded by Chris Anderson, best selling author and WIRED editor. It was all about DIY back then. 3DR supplied UAV kits and seeded the first self built drones into the marketplace. Let’s call this the “First Contact Phase.” 3DR was around for a year before the next 3 were funded in Q4 2012. Let’s call this phase the “Trickle Phase” where a few more start appearing. It wasn’t until 2013 that a few more drone startups got funded, and then there was a lull until the 2nd half of 2014 when drones exploded into 2015. Let’s call this phase the “Flood Phase.”

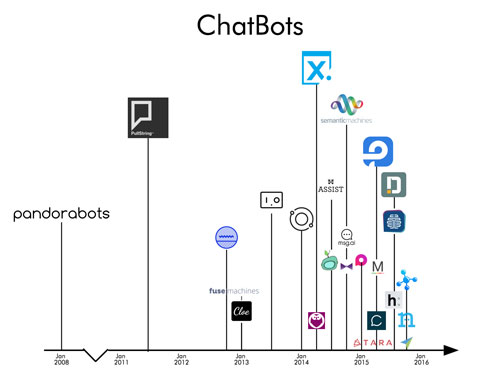

Here is a look at another sector: chatbots. We took a look at the chatbot industry and made a rough graph of startups across time (it’s a tough category because there are many working on bots, and many are working on it inside of other companies. We did our best pulling out those who are solely working on a chatbot):

The first startup appeared in 2008. Then things were very quiet for years until 2014, 6 years later, when things really started to take off. For startups, that is a long time to be surviving. It is possible that without industry and sector hype, there is suppressed availability for revenue and funding.

In either case, in the year before the main take off of the sector, there is a slow trickle of startups, and then it explodes.

When would be a good time to invest, for pre-seed/seed investors like us? Would it be better to invest in the First Contact Phase, or wait until the Trickle Phase happens? Or should we invest into the Flood Phase?

First Contact Phase

The most risky time to invest is when the first one that appears. You have the least evidence of a sector trend taking off at some time in the near future or happening at all.

For example, how would we know that drones or chatbots would take off instead of falling into obscurity or even death/dormancy until market conditions were more favorable? The first startup could try vainly to survive and die because they run out of money trying to create the market.

What drives an investment into a startup like this? It is through factors driven solely by belief. Belief in the entrepreneurs. Belief in shaky market factors that show little or no attraction to their products and services. Your own belief that this could be the next big thing. There is not much other evidence otherwise.

In theory, valuation would also be most favorable given lack of traction and sector trend evidence, although in recent years valuation variance at super early stage has not been all that much compared to others with traction and sector trend evidence.

Competition is non-existent by definition of being first, which does give this startup a unique opportunity to build the market without interference from any other companies.

Trickle Phase

A little bit less risky phase to invest in is investing in the Trickle Phase. You didn’t bet on the first, but now the second has appeared, maybe another few. Still the question remains – “Am I too early?” If you’re too early, some startups will die before the main wave appears; they didn’t raise enough money to survive long enough to catch the wave or were not able to get enough revenue.

In this phase, the market still questions whether these companies are viable and whether customers really want their products or not.

Valuation of these companies again may be lower than when the sector grows, but in today’s world, valuation may not differ much than in the First Contact Phase.

Competition increases as more startups enter the sector.

Flood Phase

And there is the Flood Phase: entrepreneurs, investors, customers, even media are all driving excitement and traction exponentially upward.

Sector trend factors are highest in evidence as many startups enter the field, and investors are putting a lot of money into them. Customers are trying out their products and services in hopes that they will gain the touted benefits.

Valuation marches upward as more conservative investors feel FOMO and must get in their bets on the trend or get left behind. Earlier startups who have managed to survive either First Contact or the Trickle Phase have gained traction and revenue, and later stage VCs invest in those, thus further motivating entrepreneurs to build companies in that sector because it is firmly hot. The media finally notices and posts are abundant about this new trend which adds even more fuel to the fire.

Competition is highest here as entrepreneurs build copycats to those who got funded before, and startups appear to tackle smaller segments of the sector. Investors who believe competition validates the market are validated!

Fast and Furious Acceleration into the Flood

As the title of this post suggests, it is amazing how fast a sector trend can move from Trickle to Flood. If you think about the overall sector I invest in, which is internet/mobile/software startups, it is easy to build something, too easy if you ask me.

When it becomes apparent that investors funding startups in a certain sector, other entrepreneurs also appear. In today’s world where accelerators are pumping out 100+ startups a year, and with the presence of media outlets who cover new startups, it is easy for someone to find a new sector to build something in, build it fast, and get out there for fund raising.

Investors are also self serving; they like to pump up the sectors they invest in for hopes that a Flood Phase will pick their own investments and drive them higher in value.

With software being so easy to write and with so many channels of public information, it basically takes nearly a year for a sector to enter and exit the Trickle Phase and explode into the Flood Phase. A year seems like a long time, but for investors it can take you by surprise. You see some hints, you process. You have conviction about some, you don’t about others. You make some bets, pass on others. If you’re an angel, you may be one of the ones saying “I love you but come back when you have a lead.” Now you’re waiting for other validation which can be slow in coming. By the time you get through all this, it’s already the Flood Phase.

Questions

The two essential questions to be answered for me are:

1. Which phase should we invest in?

I think that the phase you invest in is related to what kind of risk profile you have as investor (which makes sense) coupled with your belief and conviction about the startup and sector trend.

I’ve personally invested across all 3 phases. Of course, I’ve had more failures at the First Contact Phase where risk is highest. You make your bet and keep your fingers crossed. Looking back at my portfolio, the fastest growers have always been First Contact Phase investments.

My Trickle Phase startups have done well, depending on the circumstances.

I’ve made the least number of bets at the Flood Phase. I don’t like it when there is too much competition at the time of investment, especially at (pre-)seed. Valuation tends to be at the upper range which doesn’t work well with our fund economics.

For other investors, I think that later stage works best during the Flood Phase where it can be hard to pick the winner out of a large number of possibles, and it may be better just to wait for the winners to appear out of the noise. First Contact and Trickle Phases are better for investors who want to play in early stage.

The biggest accelerators are best positioned to see sector trends forming, as they see the most amount of startups through their applicants into their batch programs. They also see startups before the startup data companies do, because they only see startups AFTER a funding event happens. In addition, accelerators are often driving sector trends in the sense that they see something worthy of accepting and then media coverage of their demo days pushes new trends out to the public.

2. How do we find the next big sector trend?

This is the essential question that – well – can’t be answered for investors. Why? Because the answers are in the future! How can you predict the future? You can’t! HOWEVER, I think you can take some guesses and chances.

Whenever somebody appears working on something completely new, I look into it. If I never have heard of it before, I will immediately dive in. Unlike 99% of the other investors I’ve met, it is validating to me when THERE IS NO COMPETITION. If there is no competition, it is also possible that these guys are a First Contact startup in a new trend that hasn’t gotten too hot yet.

We’ve also spent a number of years looking into how to find the next big sector trend and, as you can imagine, it’s super hard looking for something that doesn’t exist. We are still trying!

Playing the market like an accelerator also helps; you must have enough conviction and resources to deploy investment broadly and be ok with a high error rate.

Many thanks to Julia Vlock for putting together the research for this post.

Monthly Archives: August 2016

Qualities of an Awesome Investor

Some of our team and I were having a chat about what does it take to be an awesome investor.

When I first started investing back in 2006, I was arrogant enough to think that, being a veteran from Yahoo and having worked on so many web products, that I was good enough to invest in internet startups. I thought I could pick well because of my knowledge in UX/design/product, and I could give a startup an advantage because I could help them in UX/design/product. On this background, I set out to try to raise a venture fund in 2006. But LPs kept telling me that while they liked our pitch (fund + accelerator – sound familiar?) and liked that my partner and I were operators by background, they didn’t invest in us because they didn’t think we had enough experience in managing investments.

“Managing investments”….what did that mean exactly? I thought I knew everything I needed to know already! So after a few months of getting the same answer, I stopped raising and went out to angel invest on my own and get this so-called “managing investments” experience.

Years later, after burning through a ton of my own cash, I realized what they meant by “managing investments.” It was definitely knowledge that I DID NOT HAVE even after working at Yahoo for so many years and the experiences I had. But spending a few years burning through a lot of cash and making a lot of mistakes, I now have a better sense for what makes for an awesome investor versus my limited naive view of the world back then.

Bringing it back to my chats at Launch Capital, I then brainstormed a list of qualities which I think make for an awesome investor and what would make an LP want to invest in. Here they are below:

- Track record, increasing IRR, value of startups in portfolio to date. Exits!

- Personal and professional network

- Previous experience, work, hobbies; new experience – what are they immersing themselves into now that is hopefully translatable into something investible?

- Ability to negotiate deal

- Personal brand as it pertains to investing – what are they doing to improve? blogging? speaking engagements? mentoring? etc. etc. it can even be putting personal money into fund(s) to get more deal flow. or getting aligned with a research lab at a university.

- Understanding the ramifications of deal terms

- Presentation and defense skills of a deal

- Proper preparation for a deal

- Due diligence completeness, up to a point (meaning can they decide when it’s not worth it to keep going on DD, or reached point of diminishing returns)

- Exit engineering – hardest skill ever. ability and connections to negotiate and execute an exit

- Deal flow and sourcing – proprietary? unique?

- Breadth/depth of information re: building businesses in typical sectors

- Ability to say no, and being able to say no whenever without any emotion.

- Make hard decisions, like cutting off $ to a startup, or firing someone like the CEO.

- Ability to serve effectively on a BOD. could start with board observer or shadowing a director who is on BOD.

- Ability to smooze a founder and get them to love him/her

- Good intuition in the area of deals, and people. spotting bullshit. knowing when something “smells” right

- Ability to clearly communicate what they are looking for in a deal (knowing that this is individual and everybody will have their own thing – uniqueness here would probably be valuable to an LP more than startup).

- Typical and special skills to help startups with, in breadth and depth.

- Ability to do research fast.

- Responsive to startups and enterpreneurs, and team members. excellent communicator.

- Participate in building brand of the organization in addition to their personal brands

- Ability to spot new trends and not just get excited about existing or old trends. ability to imagine a new trend and defend it, potentially even build evidence for it.

- Hungry to learn, curious about everything. ability to take random topics and become expert at it (enough to be dangerous). loves to read. ability to absorb lots of information from around the world and different sectors and assimilate.

- More optimism than pessimism about deals. optimistic in general about the world. not overeager naive optimism but measured, deliberate optimism.

- Ability to adjust decision process by startup stage versus applying decision critieria to everything

- Being able to work within constraints (ie. $4M pre valuation limit) and find ways to be successful.

- Company evaluation, from product to oppty to financials.

- Discipline to keep to strategy. Intelligence to know when something isn’t working and needs to change.

- Get shit done no matter what!

Having said the above, there is one quality I have found that trumps all of the above – that is….

TRUST.

All you have to do is have the trust of a wealthy benefactor(s) and you are off to the races as an investor. Why do I say this? Look around town. There are a ton of new funds popping up. I have no idea where these people are coming from. Even their experiences were less than mine when I started back in 2006 but yet they have a few million dollars to invest. How could someone like that achieve raising their own fund? It’s because they had the trust of one or more LPs to give them that start. And I have seen some great investors not be able to close their funds, even when their qualities were pretty good on the characteristics above. How can that be? I again theorize its that somehow they have not gained the trust of potential LPs to invest.

What kind of trust are we talking about? Trust that you won’t run away or waste their money. Trust that you will not do stupid things. Trust that you will make them money. Trust that they can find you whenever they want. And so on.

So while you develop those qualities above, which can only enhance your standing with potential LPs, it is ultimately the building of trust that will get their commitments to let you invest on their behalf.