Yes folks, we are a bridge happy funding community. I expect that 90+% of my seed investments will require a bridge, and adjust my expectations and funds to prepare for the inevitable ask. It simply takes too long in general to get to either breakeven or good enough metrics/traction to land the next big round – I estimate now it takes somewhere between 24-26 months to get to either on average. That doesn’t mean there aren’t outliers who do it in less time; it just means that most of them won’t be outliers and will take that long. The problem is that nobody ever raises for 24-36 months – we do see seed rounds edging higher to $1.5-2M rounds over the $500K-$1M we say not too many years ago. Still it’s tough to even push $2M into 24-36 months. If nobody raises for that long, they will most likely come back to us and ask for more money.

Lately though, I have seen startups and investors work better together and do a bridge before they really need it. I call this the Pre-Emptive Bridge.

Usually what happens is the startup looks at when they expect to raise the next round, most likely a series A, and now do it well more than 6 months in advance of that time. They now know there is seasonality in investing, and take this into account, trying to now adjust cash and burn to run out in July instead of December. They try to plan such that they can go out early in a year, say January through March, and start their series A process then versus in the fall.

Then they look at what they will have accomplished by the time they want to start raising their A. Will they have good enough preparation, traction and metrics for the A?

If they do not have good enough preparation/traction/metrics or their cash will run out before they do or cash will run out in a poor time of the year, then here comes the Pre-Emptive Bridge.

They come back to us with the outlook and the plan, and we look to raise some more money to get us to any of:

1. Breakeven

2. Running out of cash in July instead of a poor part of the year.

3. Good enough traction and metrics for a decent chance at an A, and achieving those traction/metrics at a time to go for the A starting in the early part of the year.

In years past, I’ve felt that investors were always caught off guard by the bridge. Now it seems like even angels are expecting it, and it looks like many are prepared to put more money into those with a good plan and likelihood for success. I’m not only glad for this, but also for entrepreneurs to have the foresignt to look ahead that far and take steps to increase the probability of success well in advance versus waiting until the last moment.

Category Archives: Angel Investing/Venture Funds

[UPDATED] The State of Early Stage in March 2014

A few weeks back I had the pleasure of presenting to the Silicon Valley Innovation Center, an organization which works with many Eastern Europeans on introducing them to and making connections in Silicon Valley. They wanted me to talk to them about the state of startup investing, and I chose to present on the state of early stage investing, the area where I do most of my work.

The events in Ukraine prevented many from coming, but two people did make it to my presentation. The presentation was not an upbeat one; I showed slides from many data sources stating that I believed there were some serious issues for seed investors to operate and profit from. After the presentation, I was surprised that they said I was only the presenter who didn’t have an extremely optimistic outlook on events in Silicon Valley.

Here is the presentation – it is updated to information to late March and is missing some new data that has appeared:

Just to be clear – I have no issue with entrepreneurism. I admire people who start businesses to either make money to support themselves and their families to those who go for the gold. It’s not easy to do, and it’s the Golden Age of Entrepreneurism right now. Nowhere in history has it been easier to raise some money to go pursue the dream of starting a company. Nowhere in history has there been so many resources dedicated to helping companies start. Nowhere in history has there been so much fame and attention assigned to entrepreneurism. You’re a superstar if you start your own company today.

Each day, more and more investors emerge. With the passing of the JOBS Act, soon the normal average US citizen will be able to invest in startups. And we are seeing the appearance of so many new funds. Where are they coming from? Some are angels in disguise, some are family funds, some have international origins, some we don’t really know. Still Silicon Valley is awash with money looking for somewhere to go. We can partially thank the Fed for some of this – holding interest rates at zero, making bonds a non-investment – they’ve pushed everyone out on the risk curve, and investing in startups is one of those places investors have been pushed to.

Each day, more startups emerge. Most startups I meet already have 4-6 competitors – or more. By the end of 2013, we had done our own counting and thought there would be 2500+ startups out there. Unique-ness is a hard competitive advantage to achieve. Raising a ton of money when you have little traction is much easier by far.

Who to pick to invest in? I’ve heard many methods out there ranging from “just pull the trigger if you like them”, to doing a ton of research into the market as if you were putting millions in, to “if so and so is in, I’m in too.” Still, the brutal reality is that risk is way up because it’s so easy to start a startup and thus competitors sprout the moment they are seen on Techcrunch.

Even as risk is up, valuations are also up. At one time, if something was more risky, you’d pay a better price for it. Today it’s not like that with startups. Risk is up but so is their price. The going rate for seed stage startups is generally $5-6M cap on a note, or pre-money, with jumps up to $8-12M. When I started investing back in 2006, the norm was $2.5-3.5M pre-money – there were no notes back then.

Manu Kumar just published an excellent post called The New Venture Landscape. In the section entitled, “Re-jiggering of deal stages and sizes”, he states:

Seed is not the first round of financing any more. In fact after noticing this trend last year, I have transitioned to calling most of my initial investments “pre-seed” rounds, where the company raises close to $500K, before raising a full seed round. The Seed round is larger — closer to and sometimes upwards of $2M. The Series A is now the fourth round of funding for a company — the first is usually friends and family, or an incubator (~$50K), then pre-seed (~$500K), then seed (~$2M), then Series A (~$6M-$15M).

So I can’t even call myself a seed investor any more – we are sometimes part of the $2M “seed” round but more likely we are part of the “pre-seed” round. Even at pre-seed stage, we pay a higher price generally, but yet the company doesn’t raise enough to survive on that alone and usually needs to raise more later (aka the bridge round) to keep going, assuming it gets somewhere at all. Thus, risk is up yet again but there is no reflection of that in the price we pay.

That is why I believe that while this is the Golden Age of Entrepreneurism, it is also grown to be the riskiest place by far for former-seed-now-pre-seed investors. Other stages are not immune to what is happening, experiencing things like Series A Crunch and even the potentially looming Series B Crunch. However, IMHO the issues manifested themselves first at early stage which is where things begin and the other stages don’t feel the issues until much later as it takes years for startups to grow to those stages.

What are the issues?

1. Valuations are up, but yet risk is also up. We are either paying more for a startup at the new seed stage, or in order to get a slight consideration for price we enter the more dangerous pre-seed round.

2. Competition is way, way up. It’s too easy to start a startup, so for us pre-seed investors, how do we know that it’s my startup amongst a group of 4-6 similar startups who will win?

Still, we see those who seek to disrupt the current winners. After Whatsapp’s $19B exit, how many messaging apps have appeared?

3. According to Berkery-Noyes, in 2013 the median of exits is hanging around $12-15M. Contrast that to 2008 when the median was around $20M. Remember also that valuations back then were lower than they are today – startups that exited in 2008 probably started in 2006-7.

When you invest in a startup and the median of exits is less than or equal to 2x that of where most startups will exit, you might be happy with a 2x return in today’s world where our economy sucks and we can’t make money elsewhere. The problem is that your ability to make money is not sustainable in the long run as a startup investor. Your losers will far outpace your winners and investing in startups hoping for a 2x return the median exit will ultimately lead to you going negative pretty quickly.

To give you a look into the failure rate of startups, CBinsights reports that for a given cohort of startups vintage 2009, 75% die, 21% get acquired, 4% are potential over-returners (or the elusive unicorn). That means that you have to invest in 25 startups statistically to get 1 over-returner.

Contrast that to when I started angel investing back in 2006, the venture fund folks I chatted with all told me that if you invest in 10 startups, about 5 will die outright, 4 will either return your money or 2-4x, and then there will be one that will return everything you’ve lost and then some. But that was also at series A stage; there were very few seed funds back then and the seed stage was mostly supported by angels and angel groups.

Let’s play with some scenarios. Assume you put equal amounts of money into every startup you invest. Assume that you invested in 25 startups.

First, let’s apply the current $5M pre money/cap on note metric for funding and assume a $6M post money, and use the low range of median of exits of $12M. Using the CBinsights data from 2009, 75% of your 25 startups or about 18-19 of them will just die outright. Then, 21% or about 5 will most likely return 2x, meaning that you only cover 10 startups worth of investments that failed; you have another 8-9 which still need to be covered in order for you to break-even. That means that one startup which over-returns must do so at 10x to just break-even.

Note that I’ve also made the important assumptions on the 21%. These are:

1. The 21% didn’t raise any more money and you were not diluted.

2. I also assumed that you could actually take into account ownership at the valuation of the round. Most rounds these days are notes with caps and you can’t always assume the ownership is there. In my experience, if you don’t own stock, all sorts of things can happen to your detriment even at a 2x acquisition on current valuation of the company.

I think you can assume that the above case is the BEST case scenario and all other scenarios return less than here for the average person. It also assumes you can get into right deals and not bad deals. Your own investing record can vary widely from the above.

Now for another important metric. By CBinsights count, there were 472 seed funded startups in 2009. In 2013, that count jumps to 856. Again, we are back to more competition with each other and for customers, thereby increasing risk for the average startup that is out there.

How do I cope? Largely, there are three coping strategies:

1. I keep strict valuation discipline.

2. I generally invest only in startups with no competitors.

3. I am always out there searching for the unique, special stuff and looking in places where others are not. I am patient to wait for when items 1 and 2 above align.

(Pre) seed investing has gotten to be an interesting place. I still believe opportunity is out there, but it is largely shifted towards later stages where traction, survivability, and sustainability can be proven, and for investors who can continue to invest throughout the stages of a startup, versus only being able to invest once and either follow on not at all or very sparingly.

NOTE: The strategies I employ at Launch Capital are not necessarily the strategies employed by the other directors.

UPDATED/EDITS: I wrote this post quickly and under uncomfortable conditions! Reading it over I found the need for edits. Here they are:

1. The calculation with the CBinsights data is incorrect. If you return 2x on the 5 acquired startups (21% of 25), you cover 10 startups you invested in. However it forgot to cover those 5 acquired startups so there are 5 additional startups worth of return to cover the 19 dead startups. That means you still have to cover 14 startups, not the 10 I said previously. So the 1 over-returner needs to return 15x just to break even, not 10x. That is even more difficult by far!

2. I said that this was the “best” case. I think this is the wrong word. I think “average” case is a better descriptor. Then my statement about other cases being worse is not quite correct. You can of course return better than 2x in the acquisitions, and return over 15x in the one over-returner.

Biohacking as the Next Opportunity

In early 2013, I had the pleasure of attending the Bulletproof Conference put on by Dave Asprey of Bulletproof Exec fame. It was my first real introduction to the concept of biohacking.

According to Wikipedia, biohacking is the “practice of engaging biology with the hacker ethic.” That means that you use many different means to actively alter and enhance your biology. These could be technological, or they could be biochemical, or they could simply be revealing more on your current biological state so that you can effectively take action. To most people, I think it evokes images of cyborgs and wearing steampunk like hardware on their heads. At one point the hardware may have necessarily looked like that: big, clunky, expensive, wires running everywhere, lights flashing. But today, technology has reached a new level of miniaturization and availability.

I couldn’t resist exploring the potential of these devices. I began training with a specialized electrostim machine called an ARPWave POV with the guys at EVOUltrafit. While the intent was physical results, the training is actually neurological. So while I get results externally, I find that there some amazing benefits internally. I bought a Somapulse which uses pulsed electromagnetic fields (PEMF) to induce healing and to re-energize cells, and was developed by some guys at NASA. I bought it out of frustration that my elbow, which got strained, was not healing fast enough on its own for months. In 3 weeks with the Somapulse, it was all better.

I’ve also tried the various popular fitness trackers and found them lacking. I’m also testing some sleep trackers but nothing comes close to the now defunct Zeo, which I unfortunately was too late to buy one. I also got a transcranial direct stimulation (tads) device called the Foc.us, which I haven’t played with – too many toys! I am also looking into Rife technologies – cure cancer anyone?

I also tried WellnessFX and now am a big fan of more constant monitoring of your blood markers AND the ability to do it without requiring a doctor to prescribe a blood test – direct to consumer still has not seen its full potential but I have seen the value of it. While blood draws may make people cringe, companies like Theranos are changing that to drawing only a few drops of blood (and by the way, 10x cheaper)! I am also actively working with a functional medicine doctor at JustInHealth to get my blood markers back into healthier levels. With my thyroid and adrenals number back in place, every day I have more energy, resistant to disease and more resilient to the stresses that occur in my life.

Much of these technologies are on the fringe still; early adopters and hobbyists messing around with interesting devices, some getting good results, some questioning. It also requires a level of commitment, education, and initiative that most people don’t have. Most people are totally passive on their health and physical condition and just wait until they get themselves into an unhealthy corner before doing something. By that time, it may be too late.

Experiencing the potential of these technologies firsthand and seeing the explosion of such devices across the internet and across crowdfunding platforms like Kickstarter and Indiegogo, I believe that we are on the edge of a new opportunity for startups to create something really new and impactful.

The challenges I see now are:

1. Most of this technology is still complex and requires a lot of effort on the part of the user. Until it is simplified further, wide adoption could be very difficult.

2. The customer base needs to educate themselves on taking control of their health and wellbeing. This will take some time.

3. It is possible that a simpler product could make a customer acquisition strategy work in the short term. One issue I have seen is that companies who have done this do not have the expertise or knowledge to advance their products beyond where they are now.

4. The hardware itself needs work. At the moment, wearing the devices can be cumbersome and uncomfortable. Power requirements limit usage times. Even something as simple as wearing a heart rate monitor belt around your chest all day is annoying. I also think that wireless technologies still need advancing. Bluetooth LE is a step forward, but I find that there are still issues.

The startup who can take a biohacker technology AND figure out the broad adoption problem will really have something. I’ve experienced firsthand the results of biohacking and there is way too much value to not bring to the general population. But for them, it’s a user interface problem applied to super high technology; hide all the wires and blinking lights and make it one button easy.

I’m excited to see science fiction become reality in my lifetime. As a startup investor, I plan to be fully immersed in biohacking technologies in my search for the next winner.

“I’ve Never Heard Of That Before”

In recent weeks, many people have asked me what I look for in startups today. My leading answer has become:

“I’ve never heard of that before!”

As I glance at the flow of accelerator demo day lists and what gets funded on popular news outlets which cover startups, my brain files away stuff that I see. Startups that do this, do that. I may not remember their names but only what they work on or do.

But every once in a rare while, I’ll meet a startup working on something that I’ve never heard of before. I’ll look into what my brain has filed away and can’t even find someone working in a space that is close to it. This is what gets me excited – people working on projects with no competitors.

Back in the old days of venture capital, I heard that lack of competition was something they all looked for. It seemed very important back then as a way to maximize the odds of success. Certainly the world was less filled with startups of all sizes and shapes, which is very unlike today.

However, in today’s world, I see people with multiple competitors get funded all the time. There seems to be the hope that maybe you invested in the winner and not the other guys. When I look, I just don’t know if the startup I’m talking to is going to win, versus the other guys. It just seems too risky to me.

The world is way too filled with things for people to do, or choose from. This affects both consumer and B2B startups. Traction slows down and takes too long for startups to get to break-even or good enough metrics for the next round. When a product or service has other people working on the same or similar things, customers need to process “blur” and need to decide on whether they want to spend time to determine whether something truly is better or not. In my experience, most people just bail – and they wait until enough other people use something before they will even try it.

The only way to combat this is to present something to a customer that they have never heard of before. It must be so unique that the time to process is minimized. That gives them a leg up in acquiring customers. If there is no one else shouting/touting the same or similar product, then they can gain some initial traction without interference from others. They can pull out ahead before someone else gets the idea to build a competitor.

Some of you might think that is nearly impossible to find someone working on a product or service with no competitors. I think that is mostly true; the easy pickings are already being worked on many times over. And yes it’s really hard and takes a lot of patience to wait for an encounter or it’s a lot of work to go looking for them.

It’s the big markets that have not been touched by and disrupted by new technologies that I’m excited about. A lot of that is in unsexy markets, things that definitely that newly graduated college kids will not have been exposed to. Some of them require a ton of time to dig into and understand. Some of them are so unsexy that it requires real effort to fall in love with!

Unicorn hunting is fun and all, but I prefer to look for my unicorns in places where hunters are not. My first attraction to a startup is most likely the realization I have never heard of their product/service before in an industry that hasn’t been worked on yet. Then I rally the forces and dive deep from there.

Demo Day Burnout

As summer moves on, we are soon back into demo day season for the fall. But yet as I attend these demo days, I find myself getting kind of bored. What do I mean by bored?

They seem so formulaic. The tone of each presenter is the same. Exciting, loud, forceful, confident. The flow of each pitch is the same. There are minor differences: some start with heartfelt stories, all end with graphs rising up and to the right with markets in the billions, and a “If you love [insert appropriate noun/pronoun here], then come find us”. In their attempt to be the best of the best, I am finding that they are all starting to sound the same.

I can imagine what a movie or TV show writer or producer might feel like. These days all you have to do is go to TV Tropes and you can basically find the underlying story line for practically every movie or show out there. This is also why I get bored watching most movies too; it’s the same story but just with different actors and in a different place. Truly special is the time when you stumble upon a movie that someone has done something really different….or perhaps it’s just a trope that I haven’t seen before…?

Somebody should do demodaytropes.com. Then it would just be easier to put together not only each individual pitch, but also the whole show. We could just collect what everyone has done and then you could just look up the demo day trope that fits best with your presenting style and situation.

Of course that would probably just make the whole demo day thing even more unmotivating to attend.

The formula does makes my job as mentor a ton easier. For instance, a few 500startups mentors and I spent many recent days with the startups of the current class to fine tune their upcoming demo day pitches. I sat with some in my mentor hours and went through their decks. There were a few where I actually would rejigger their pitches and then present it back to them in the same tone/style/voice as the many I’ve heard in demo days of the past. Boy, did I sound awesome – well, at least in my own head! I imagined myself acting out the many demo day pitches I’ve heard and just inserted their information and startup name. Almost too easy, right?

Then, when each demo day has 20, 30, no, 50+ startups to present – it’s just getting harder to pay attention simply because of the monotony of the presentations.

Can it get better? I heard that Techstars had loud rave music in between each presenter and one of the startups brought a cadre of supermodels on stage. What else? Any way to make them more interesting beyond the uniformity of their super rehearsed, super confident pitches?

Betaday 2013 Pictures

Some photos from the event – Enjoy!

The Foundry |

View from the balcony |

The crowd eagerly awaits the start! |

Cool glass ceiling |

John Borthwick opening remarks |

Baratunde Thurston, our MC |

Ricky Engelberg, Experience Director, Digital Sport of Nike |

Andrew McLaughlin interviews Emily Bell of Columbia |

Marc Ecko on Unlabeling yourself |

The Gillmor Gang |

Gilad Lotan presenting recent research |

Paul Murphy talks about the HIR program |

Aleksandar Kolundzija on Blend.io |

Kuan Huang presenting Poncho |

Matt Hackett with Teleca.st |

Jace Cooke presenting Giphy |

Patrick Moberg with Dots |

Hackers in Residence 2013 |

Google Glass sighting No. 1 w/ Robert Scoble |

…and discretely using it all day… |

Nick Steele with Google Glass sighting No. 2 |

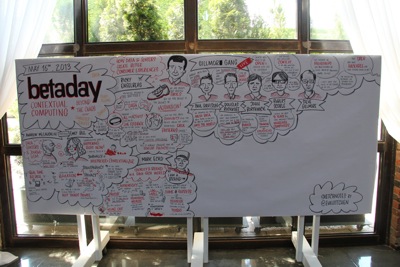

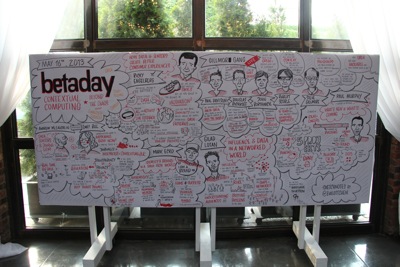

Betaday concepts captured on paper |

|

|

|

| Last but not least, the ever present GoPro camera which was everywhere capturing time lapse pics  |

|

See my previous post Betaday 2013 by Betaworks for a brief synopsis of the day!

Betaday 2013 by Betaworks

This last week I was in NYC and attended the 2013 Betaday, put on yearly by Betaworks.

It was a smaller, more intimate event this year, which was more similar to the first few Betadays – only 100 attendees which made for better networking overall and not being overwhelmed by all the people there.

IMHO it also heralded a second coming for Betaworks, on the heels of an amazing Hacker In Residence (HIR) program, managed by Paul Murphy, formerly of Aviary and Microsoft.

Back in January of this year, Paul had told me of his plans for the HIR program. Attract super multi-talented hackers; give them the full support and resources of Betaworks; let them build whatever they want to build. Out of it came a pretty wide (and awesome!) assortment of products:

Poncho – Personalized weather reports

Telecast – Handpicked video, delivered daily

Dots – A game about connecting

Blend.io – An open Collaboration Network for music creators

Giphy – search animated GIFs on the web

And not to mention recent product launches outside the HIR program which were equally awesome:

Rushmore.fm – stay up to date with your favourite artists, show off your current jams, and connect directly with the artists and labels you love.

Tapestry – Exclusive short stories presented in a beautiful and unique reading experience on mobile.

Done Not Done – The to-do list for things you want to do, not the things you have to do.

AND…can’t forget the acquisition of Digg last year and the recent acquisition of Instapaper, both significant additions to the collection of products in the Betaworks portfolio.

Being an investor in Betaworks, I’ve been a part of the family since 2007 when I first met John so many years ago. I’ve watched Betaworks’s evolution over the years, and it seemed that in recent months, they had substantially increased the output and influence of its operations. For this, I am supremely elated, and Betaday was the perfect time to celebrate our recent developments.

Betaday was held at The Foundry in Queens. A very cool spot for an event, it was also quite an adventure getting there and wasn’t sure I would get back home OK.

As always, it was a gathering of both Betaworks family members and notable people in the industry. The witty Baratunde Thurston was our host, and the speaker set was great this year. We saw presentations and talks from:

Ricky Engelberg, Experience Director of Digital Sports at Nike.

Emily Bell, Professor of Professional Practice & Director, Tow Center for Digital Journalism at Columbia.

Marc Ecko, American fashion designer, entrepreneur, investor, artist, and philanthropist.

The Gillmor Gang, featuring Steve Gillmor, Robert Scoble and his Google Glasses, Doug Rushkoff, media theorist and author, Paul Davison of Highlight.

Gilad Lotan, the in-house data expert at Betaworks.

Paul Murphy presenting the fruits of the HIR program.

My personal favorites were the talks by Ricky Engelberg and Marc Ecko.

Ricky gave a great overview of Nike’s thinking and strategy with all their digital products, with the latest being the Fuelband. They see the Fuelband is the beginning of a whole line of digital products that motivate you to greater health and fitness. I’ve always been fascinated and impressed by Nike’s strategic thinking, which is very much aligned with their marketing and advertising. It was great to see them using 3D printing to design their next generation shoes, and someday soon, they will be 3D printing them as well. As a guy who believes that hardware is a huge trend, Ricky’s view of the world is one I share where digital devices can enhance our lives greatly.

Marc Ecko’s talk mirrored his upcoming book, Unlabel: Selling You Without Selling Out. It was an open look into his life and his pursuit of design, influence, and fame, and then seeing it come nearly crashing down into bankruptcy. It made him realize what was most important in life and it wasn’t bowing to the thinking of others, but rather really finding who you are and not compromising that. I look forward to reading his book when it comes out this fall.

Many kudos to Lauren Piazza, Betaworks operations manager, and her team for putting on a stupendous event. I thoroughly enjoyed Betaday 2013 and look forward to many more. As always, it is an honor to be part of the Betaworks family.

Demo Day Tips Volume 2.1: Essential Timing

Two more thoughts on Demo Days:

1. Given the plethora of accelerators out there, the scheduling of the Demo Day is challenging because you don’t want to hold a Demo Day to close to another one. This is because you don’t want to overload investors in their time and attention to give the best chance for the startups to raise money – there is enough competition amongst the numbers in the class; you don’t want to add to the competition across accelerators!

However, they still do tend to clump together because the classes are generally held corresponding to the seasons or months in the calendar year.

The thing to note is that post-Demo Day, you really need to work as fast as possible to close funding because if you don’t, you could end up running up against another Demo Day which could take investors’ attention away from you.

For example, looking at the winter 2013 classes from earlier this year:

500startups Demo Day Winter 2013: February 6, 2013

Ycombinator Demo Day Winter 2013: March 26, 2013

A startup coming out of 500startups has effectively from February 6 to March 25, only about 2 months, before attention shifts to Ycombinator.

So work your magic on investors as fast, efficiently, and effectively as possible before the next Demo Day comes around!

2. This thought is related to Demo Days, but it more broadly has to do with optimizing Demo Day through which class you apply for.

In my previous post, Investment Pacing and The Timing of Fund Raising for Startups, I talked about the fact that the first half of the year is better for fund raising than the second. If this is true, then there are batches of accelerator classes that place you in the marketplace at the most optimal time for fund raising.

This means that the winter classes whose Demo Days end up in the early part of the calendar year have a longer period of time uninterrupted by investor seasonality than those who occur in the second half of the year. It means that the probability of you raising money is also greater if you have no interruptions due to other factors. So it may be worthwhile to work to get into winter classes than for a class in another part of the year.

Timing is everything – competition between accelerator classes and startups for limited investor time, attention, and money is fierce so optimize it wisely through timing.

Demo Day Tips Volume 2: From Day One to Winning the Pageant

A while back I was part of the short lived mentor program at YCombinator and wrote this post in response, Tips on Demo Day and Afterwards for YCombinator Startups. It was in reaction to easy to fix mistakes that all their crop make come the days before, during and after Demo Day.

Over the years after I wrote that post, I have mentored many startups, most recently at 500startups and ImagineK12. It seems that each startup, even at the beginning of the accelerator class, worries about their performance at Demo Day!

The previous post was more about the days closely surrounding Demo Day. However, I think there are more things to consider now that begins through the entire time in an accelerator program. To perform well at Demo Day, you should start thinking about Demo Day from Day One the moment you get there….

Day One to 1-2 Weeks Before Demo Day

In past accelerator classes, I always knew that there was friendly competition between the startups to give the best presentation possible on stage, over that of the others. However, startups sometimes don’t realize this at the outset.

It is important to know that intelligence gathering on your fellow startups in the class should begin as soon as possible. What should you look for?

1. Who has the most traction and revenue. These will be ones that investors will keep their eye on the most.

2. Who has the coolest product, regardless of traction. These will be stars of the show from an “ooh-aah” standpoint. They will be memorable simply for their coolness.

3. Who has raised a round already. Somehow they wooed investors and may not need Demo Day to do so, or they may be announcing a bigger round then. But it is impressive when someone can get up on stage and say “we’ve already raised our round”.

These will be your biggest competition on stage come Demo Day. You should watch out for these startups and figure out the best way to top them on stage. Rank them all from 1 to X and see where you stand in that list. The ones ahead of you are the ones you need to top – you only have from the beginning of the program to the end so work fast and smart!

Having said the above, and while I think they are your competition for Demo Day results, I also do believe that you will all more likely succeed if you all support each other and work together. So save your high priced service for those outside the accelerator; give your fellow startups a break so that you can all get the best chance to execute well by Demo Day. Support each other through the highs and lows; give advice freely and don’t undermine anyone.

What are the categories to excel at? The basic categories are:

1. Traction, exponentially rising metrics

2. Revenue

3. Product awesomeness

4. Technology – unique? awesome? defensible?

4. Design excellence

5. Customer acquisition strategy, marketing excellence

6. Market size is huge

7. Founders are awesome

8. Previously committed investors, especially well known ones – social proof in action

9. Vision

In general, you should maximize your showing in as many categories as possible, and then better than anyone else in the class. (A good read: Brian Witlin’s 10 Topics To Know Cold for Your Perfect VC Investor Pitch).

At one accelerator, a few startups told me that some had given them some basic numbers in traction and revenue they should hit in order to give them the best chance at getting investment. To me, if this is what someone told you, then you should treat this as the average and fight/execute to exceed these metrics! Everyone else may be attempting to hit this average, but you should try to go beyond it to look better!

Up to 1-2 Weeks Before Demo Day

OK so you’ve spent the last few weeks or months working your butt off to try to be the best of the class. If you’re executing strongly, then you’re off to the races.

But if you’ve tried your best and you’re still lagging, what do you do? DON’T DESPAIR. Work on things that are under your control, like product awesomeness, design and technology excellence, market size is huge, and vision.

While the more traditional way of getting funded is excelling at those previously mentioned categories, I’ve seen startups get funding on much less progress so hope is not all lost. The idea is to NEVER GIVE UP (essential quality of any great entrepreneur).

Peacocking

If you’ve read The Game by Neil Strauss, you’ll know that “peacocking” is what you do if you walk into a bar and try to pick up women. You need to look bigger/better/different/more flamboyant/more whatever than everyone else in there. In doing so, pickup artists have learned that they can pick up anyone!

I believe Demo Day has become about peacocking not for women, but for investors. Demo Day itself has become the pickup bar for startups. It’s full of investors and you want to get their attention. Otherwise, someone else is going to get the attention and you’ll be left at the bar alone with your drink. That sucks! Don’t be that guy and see someone else walk off with the hottest investors in the place!

How might you peacock?

It may be as simple as all of you wearing brightly colored T-shirts, or some gimmick like a sweepstakes, or give away some cool gift (like T-shirts; one startup made Dr. Dre clone headphones to give away to investors who talked to them!).

It may be something amazing in your pitch. This something could be one of the typical previously mentioned categories, or something else entirely different. One startup I know put up a demo so amazing on stage that he generated a murmur of “ooohs” and “aaahs” through the audience, which resulted in a whole bunch of people coming up to him later asking him how he did that!

The Beauty Pageant

Another way to look at Demo Day, since it’s on stage, is that it’s a beauty pageant. All of you are clamoring to be Miss Universe so you better have a great showing across all categories. You’re all competing, trying to look the best against the other contestants. Actual awesome performance in the previously mentioned categories helps a great deal and may be enough; peacocking adds icing on the cake (especially if there is, unfortunately, little cake, if you get my meaning).

The big prize is your two goals – the first is to get investors to come up and talk to you. The close second is to get them to invest in you. But you can’t get the second without the first happening!

Keep that in mind as you’re prepping for your stage debut. Whether it’s through actual excellence in execution, or peacocking, or some awesome demo, or other thing, your overwhelming goal is to get investors to walk to you. You don’t want to be standing around waiting for people to come up to you; find a way to make them all want to talk to you – be Miss Universe with the biggest/brightest feathers!

1-2 Weeks Before Demo Day

Prep as in my post Tips on Demo Day and Afterwards for YCombinator Startups. Make business cards and T-shirts, etc. Get the list of investor attendees and research potential investors who are your number one targets.

Practice your pitch OVER and OVER again until you are reciting it in your sleep and can do it without slides or help. Deliver it live multiple times to friends, mentors, and others until it is fine tuned to nth degree.

At 500startups, there are big blocks of hours dedicated each day and evening to let startups pitch practice. We mentors and others sit in on this pitch prep and give feedback. You should go to each one, get feedback, edit the pitch and then go back to the next session to pitch again and again and again until it is perfect.

Note that it can be a frustrating experience getting pitch feedback from different individuals because each person may tell you completely different things to change. Just gather it all, make changes that work for you, and make it flow the way you want to deliver it – remember that you’re the one pitching and you’ll have a particular style or personality, so you should make it your own. Try our suggestions; see if some fit and if they don’t, toss them. It just needs to be cohesive and flow coherently and there are a thousand ways that can happen. We’re here to help you with our feedback (and maybe confuse you), but YOU own this pitch, not us.

Also, remember that sometimes there is more than one Demo Day depending on the accelerator. If you have more than one pitch to give, think of it as a performance where you have to perform the exact same show every night. That means you’ll need to have perfected the emphasis, the jokes, the words, the dramatic pauses and deliver it exactly the same way each time.

Demo Day

The day of the beauty pageant is here. Enjoy the day, relax, and deliver the pitch in the best way possible. Then get out in the crowd and network (peacock) like crazy! Read my previous post for tips on the day of Demo Day.

After Demo Day

It ain’t over! Now comes the follow ups and communications to get investors on board. Get organized and track your progress. Set up meetings with investors. Read my previous post for tips on post-Demo Day.

Being in an accelerator class is one of the best things you can do to help you make progress and get funding. Make the most of your time, optimize it from day one to Demo Day.

Corporate Due Diligence Fast and Easy

In two past posts, I talked about doing due diligence on startups. The first one was The Lack of Due Diligence is Appalling and Foolish where I lamented that most investors I met out there did virtually no due diligence whatsoever. Then I talked about how simple and easy doing The Due Diligence Customer Call was, and some suggestions on what to ask. There are two more topics I would like to tackle in the due diligence area. Last year, John Lanahan in our research team tackled research due diligence in Efficient Research: The Lean VC Way. The last part of due diligence that I will post about today is corporate due diligence.

In my Lack of Due Diligence is Appalling and Foolish post, I give a short list of documents I ask from the startup before investing. I have expanded that list slightly, adding debt obligations, business contracts, and then I modify it based on the situation and startup in question, but it has essentially been the same over the years. Most of the time I collect all this into a Dropbox folder and send it to my lawyer for review. It has always amazed me that it takes him only 1-2 hours to go through this- I guess when you look at a lot of this stuff, you get used to reading it and picking out specific stuff to look for. Every now and then, I get the opportunity to do corporate due diligence myself and yes I can definitely say it can take you only an hour to do this!

Generally, the corporate due diligence step I leave for the last step, after doing customer calls, reference calls, and research on the market. I don’t want to ask for corporate documents unless everything has checked out up to this point, since those documents are confidential to the company and I want to respect that.

Note that I am ONLY talking about early stage startups: companies that have been only in existence for less than a year and have not had many business operations. Corporate due diligence can grow exponentially when the company has been in operation for years and then there are tons of documents and contracts, which can take teams of lawyers weeks to review. So feel lucky that at early stage, you don’t have much company history to go through! But sadly, there could be a lot still to worry about….

So yes it can take only an hour! Just a few months back I did just this with a startup and zinged a bunch of questions back to them for inconsistencies and missing items. How does one do this? Some tips:

1. Do this often. Get used to reading legalese and understanding it quickly.

2. Learn to recognize standard legalese in corporate documents and when they diverge.

3. Learn to read and scan text quickly.

4. Take notes in a separate notepad or document while reviewing, so you can come back to important points or questions.

OK those are the preliminaries; now what to look for? Some common things I’ve learned to look for are:

1. Which items in the list are missing and why?

2. How many shares are authorized in the Articles? It is better to see 5M or 10M authorized. I would raise a flag if only 10K or similar shares were authorized. Lower numbers authorized also can indicate that someone incorporated by themselves at some online easy incorporation website – not the best option.

3. Scan through the board meeting minutes, assuming they exist. Identify any inconsistencies in personnel, consultants hired, stock granted to individuals and why, business dealings, operating directions, and information in the minutes and the other documents.

4. In the stock purchase plans, are people vesting or do they own stock?

5. If there have been previous financings, what do the terms of those financings look like? Do any have any effect on your money coming in at this time?

6. If there are any contracts, are there any problems with those contracts relating to future business?

7. If there is any debt, are there any liabiltiies to be aware of? Any liens on the assets of the company? Who gets paid back first and when?

8. Who is the lawyer? Be wary of lawyers who are not familiar with early stage startup work. Their lack of experience can cause all sorts of unwanted trouble – doesn’t mean they aren’t good lawyers, just means that lack of experience on what is acceptable and what is not can be a barrier to getting things done.

9. How much is owned by founders, employees, and, if any, previous investors? Is this acceptable to you?

10. Go to the site of the state in which they are incorporated and search for them in the incorporation database. Make sure they really exist there!

11. Write down all people and companies you encounter in the documents. Did they get money or stock? Or were there contracts that were entered into? Are they accounted for in other documents? Check the cap table – is anyone missing? Check on why anyone would receive money from the company.

There are many more that come up, but those are ones that I’ve encountered in previous deals. I also asked my lawyer for a broader set of Top 10 things to look out for, from his perspective, listed here:

1. No Organizational Resolutions (after Articles, to set up the company, appoint officers, etc.), or they are incomplete.

2. No qualification filed in state of domicile (e.g., DE company located in CA, no filing made in CA).

3. Docs are provided, but they are unsigned.

4. Company is set up by an Incorporator, but there is no Action by Incorporator adopting the Bylaws and appointing the initial Board.

5. Stock Options granted, but a Stock Option Plan was not adopted by the Company.

6. More stock issued than is authorized by the Company’s Articles/Certificate of incorporation.

7. No Board Consent or Minutes approving the current financing.

8. Notice of Stock Transaction (in CA, a 25102(f) Notice) not filed with the State for the sale of stock.

9. No Cap Table.

10. Founders acquired stock but did not sign a Stock Purchase Agreement.

My list and my lawyer’s list provide a great starting point. These lists are not, by any means, exhaustive. My best recommendation is always to collect the information and then send it to your lawyer for review and spend the money for it to be done by a professional. In lieu of that, it is always educational and interesting to go through these documents by yourself and try to spot potential problems. I always scan the documents, even when I send them to my lawyer, for practice, and also to double check his work because sometimes I may find something that he may miss, or I may care about something due to the nature of the company and situation but he won’t know it’s important since he isn’t as close to the deal as I am.

The next step is to then decide whether you’re OK with what you found or not. At early stage, it is common to find lots of corners have been cut to get to where they are now. Many early stage rounds are completed with big discrepancies in the corporate documents unfixed. If an institutional investor comes in, they will most likely demand clean up. I have often asked to clean up, even at low levels of investment. Rarely do I find that an entrepreneur won’t clean it up; most of the time he/she knows it has to be done anyways, so why not now?

Other red flags:

1. I have asked for corporate due diligence documents and the entrepreneur has refused to provide them.

2. The entrepreneur doesn’t want to clean up the documents, or constantly backpedals when you ask.

I have walked away from deals, after doing all sorts of other due diligence and then got to corporate due diligence and either one of those red flags pops up or I find something that I cannot live with. Do not skip this step!

Doing corporate due diligence is a necessary step no matter what the level of investment. It is best done by spending a little bit of money getting a professional eye to look them over. And it can be done on the cheap by doing it yourself.

Thanks to Mark Edwards of Edwards Law Group for contributing to this post.