These last two weeks were a whirlwind with YCombinator happening and then the subsequent meetings with their entrepreneurs afterwards. It was a great event and very tiring and brain draining with 36 companies to listen to. Hollywood was there with a guest appearance by actor turned angel investor Ashton Kutcher and wife Demi Moore.

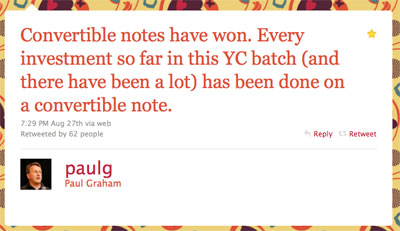

One interesting thing that did happen was that everyone was raising money in convertible notes. Paul Graham tweeted out this fact:

Now, anyone who knows me knows that I hate convertible notes. See all my misadventures with notes in this blog category.

However, once I took a look at their “standard” note, I had to say that, as far as convertible notes go, this was probably the most palatable convertible note I’ve seen to date.

I used to encounter totally barebones notes, but with an option to convert at the next equity financing. Those disappeared as investors started becoming smarter about financing, but, as funding rounds got lower and the cost of starting an internet startup dropped, the cost of doing a preferred equity round became expensive relative to the amount they were raising. This is also changing too as the creation of standard early stage equity round documents has helped this process, but still it was more expensive than doing convertible notes.

Then came the convertible note with a price cap on it at conversion. This eased some issues but didn’t totally erase others; even those notes were still very company friendly in many respects, and I encountered some of these issues with the notes I invested in.

Taking a look at the “standard” YCombinator note that is used with this class, I must say that it is more complex than the standard simple convertible note, but I think it does give a lot of advantages to the investor which other notes do not.

First, it has a price cap on the conversion – infinitely better than barebones notes with no price cap.

Some of my concerns deal with the 5 conditions in which a startup might find itself in, relative to this note. These are, with why this note is better in these conditions:

1. The startup is doing great and is raising their next round at a value above the cap of the note.

Comment: This is the best condition and the cap delivers price advantage. One potential issue is in what terms does the next round enter into. With a good lead, this generally is not an issue.

2. The startup is doing OK but will raise their next round at or below the price cap.

Comment: This is not the best condition for the company given its progress, but we as investors at least get the best price which will be below the cap now.

3. The startup is doing great and is profitable, and the note comes due when the startup doesn’t need financing.

Comment: Here other notes present a situation where they can pay us back and we don’t end up with any ownership of the company. This kind of sucks because we intended on ending up with stock in the company but didn’t get any and only got interest. However, this note has a term where when the note comes due and if a financing has not occurred we have the option to get paid back or convert, and convert into a preferred equity round with terms defined through an attached term sheet. This is the important part: we can convert into a preferred equity round that has pre-defined, balanced terms, and not into common stock or get into a negotiation about preferred equity terms in a situation where we would not have leverage to negotiate.

4. The startup gets acquired before the note comes due.

Comment: In case of change in control, we have the option to automatically convert and take advantage of us owning stock and getting a piece of the proceeds of any acquisition or exit. However, we have the option to also just get paid back, which can be advantageous to situations where the exit would result in us getting less money back if we were to convert to common stock. As investors we can choose the best condition for the situation we find ourselves in.

5. The startup raises their next round, but no one leads and the terms aren’t being set or driven by anyone.

Comment: This is one which I have encountered and is problematic because a qualified equity financing has occurred, but no one steps up to lead the round and drive the terms. If the company is left to its own devices, it will most likely deliver company friendly terms. Currently the note doesn’t quite take care of this condition. In the case of a non-qualified equity financing, then we use the terms as set in the attached term sheet.

I hope that this form of convertible note with cap gets out there regardless of whether we think notes are a trend over doing preferred equity. I think the jury is still out on which form of financing will we do more of. As an investor, I still hate notes and would much prefer preferred equity financing. But I do understand the economic issues where doing notes is cheaper than doing equity…at this time. Other movements in the industry may make this obsolete.

Kudos to Paul Graham and the Ycombinator crew for putting forth a convertible note that is much more friendly and palatable to investors than previous or more common instances of the convertible note.

No matter what entrepreneurs really need to do the math to see how much dilution will happen in all these cases. I have seen entrepreneurs who have delayed the question of ownership by using a convertible note, and then got some unexpected news when they raised the next round and they were diluted a lot more than they thought.

Summary:

Key terms and items in this note are:

1. Cap on the conversion price.

2. Interest rate.

3. Automatic conversion happens when qualified equity financing occurs and we convert into that preferred round’s terms.

4. Investors can convert at their option (on majority vote of investors) in a variety of situations. These are at 1) non qualified equity financing happens, so we can convert to preferred stock via the attached term sheet; 2) maturity of note, so we can convert to preferred stock or get paid back; 3) at change in control then we can convert to common stock before the change in control or get paid back.

5. A preferred equity round term sheet is already predefined and attached to the convertible note, to be used in conditions where we may convert into the company’s equity.

Category Archives: Convertible Notes vs. Equity

More Reasons Not to Invest in Notes

Way back when, I was happy to have encountered Josh Kopelman’s excellent post, Bridge Loans vs. Preferred Equity, to which I did sort of a re-post but also added my spin on the subject in Convertible Notes versus Preferred Equity Parts 1, 1.5, 2, and 3.

Now that I’ve been out here for about two years angel investing, I’ve uncovered more reasons not to do notes any more. So much to learn but yet no one to learn from except to fumble about and get myself into trouble. Now I’ve firmed up my rule to never invest in notes. I *might* do a note with a price cap on it, but it is still not without potential future issues. Here are some more reasons why notes are awful:

1. It is possible that the company you invested in achieves significant revenue, enough to do one or both things:

a. The valuation will inevitably jump. So when you put in your money, you expected the valuation to be one value, but when your note converts, the valuation has gone higher and now you’ve taken all the early risk with your note investment, but have lost share in the company upon conversion.

b. The company has enough revenue that it may not need further investment. Or it can delay seeking investment. If the company does not need further investment, then you’re in risk of just getting paid back and not obtain any share of the company. This can also happen if the delay in seeking further investment takes the next fund raise period out beyond when the note is due. Again, you could just get paid back instead of converting into equity.

It is possible to convert still, even if there is no conversion. But it depends on the entrepreneur and they are under no legal obligation to do so.

2. The valuation may jump anyways independent of revenue. Again, if/when you convert, the value of your participation will shift from where you originally put in the money, and it doesn’t reflect the risk of your early investment.

3. The terms of the next equity financing are unknown to you at the point you invest. While it is easy to ignore this in the excitement of doing an investment into a note, any problems that may arise will come up later during the conversion process.

You would think that at conversion time some large and/or experienced investor would take care of negotiating the proper terms. In most cases, this is true. However, it is also possible that not-so-favorable terms may appear and seem to be proposed by seemingly experienced investors. The big issue is that you don’t know what you’re converting to with a note at the time you give up your money; then, if you don’t like the terms, you’re kind of stuck into accepting them because you can’t get your money back. Unless you’re leading the investment, you won’t be able to affect them much. However, if you do get stuck in one of these situations, I would advise you to speak up about the terms; you never know when you’ll be heard and someone might actually change the terms to your liking.

Notes don’t align investors and entrepreneurs, and now I’ve discovered other reasons not to do notes…

Convertible Notes versus Preferred Equity Part III: The Investor

In the last few months in working with financings, I have gotten to know the Convertible Notes versus Preferred Equity issue very well. As an angel investor, I am constantly thinking about maximizing my money and I don’t have the cash to play the field in a broad, diversified way to not care about this issue like some larger angels. Thus, knowing when to take a deal or walk away is part of the game, and certainly financing terms are part of that decision.

Again, I reference Josh Kopelman’s post on Notes and Preferred Equity and think it explains many details well. I’ll talk about this topic with his thoughts and some of my own in mind.

Why would I be OK with a Note?

The terms must be good.

Often Notes have no anti-dilution provisions or special provisions that help us in case the next equity financing does not occur. They seem to be hastily drawn up and many details are left out. I have walked away from Notes that didn’t have enough good terms in there.

They are mostly unsecured, so I’m OK with that. I know that I’m dealing with an early stage startup and they have little or no assets at this point. What would I do with 1/10th of a PC?

I also want to make sure I am not locked into a particular Next Equity Financing by default. I want to have the ability to back out if company conditions change.

If they require an auto-conversion provision in their to the Next Equity Financing, then I want them to insert a minimum on the money raised, to ensure that they don’t do something screwy.

In truth, I don’t pay much attention to the interest rate return for early stage startups. This is usually a make or break time for them. If they don’t get the Next Equity Financing, then often the company will tank and I won’t get any interest payment or my money back yet. I do just make sure it is in range of other Notes I’ve seen which is about 6-8% per annum.

There is a Preferred Series financing imminent.

Most Notes are used to gain cash to continue company operations just prior to a first Preferred Series financing. My goal is to always get share of a Preferred Series. If I know there is one coming soon, then I’m OK with a Note knowing that I’ll convert in a few months. Time is minimized between the Note and the Preferred Series and there is a less of a chance that the company valuation will change dramatically, causing loss in ownership share from when I invested and when it converts.

Why would I NOT be OK with a Note?

There is no Preferred Series in sight, or I am not confident it will happen soon.

If the Note is being raised, but they have nebulous plans for raising the next Preferred Series. I won’t do it. The risk of it dragging on for a long time is there, and the more time that drags on before I gain actual ownership in the company, the more chance that it goes not in my favor. The valuation could go up (meaning I convert to less ownership than I originally thought), the company could go under with not enough funds, or I mayjust get paid back and not reap any benefits of having ownership in the company, if the company starts gaining revenue. The company need not be going under for you to not gain the benefits of investing in a company.

Or they may SAY they are going for Preferred Equity fund raising, but I get the feeling they will drag their heels or avoid seriously doing it. As soon as I get some intuition that this is true, I won’t do it.

This is a second (or beyond) Note they are raising.

This begs many questions. Is the company trying to be greedy and not give up any ownership? If so, they can build their company on other people’s money then. I want to maximize return and getting interest rate return on my money is not the way to go.

Or you have to wonder why this is yet another Note. Why do they need another Note? Why haven’t they raised their Series A? Or what is wrong with them that they can’t raise their Series A? Many Notes are written vaguely that the Note will convert to Next Equity Financing. They may actually want to convert the last Note holders to the terms of the second Note which may be less favorable to them!

Unfavorable Terms.

Although this may seem like a given, it could mean that the company opportunity is really good, but the Note terms are not.

Terms always take care of the worst case scenario and nobody wants to see them come into action. But sometimes, the terms are there and you can’t change them. I’ve already had a case where I wanted to change the terms but the entrepreneur did not because the current terms were already approved by the lead investor, and he did not want to scare the lead investor off. But, it was obvious that the lead investor didn’t really read the term sheet carefully because some of those terms were bad even for him.

By the way, I think this happens frequently in the Valley. There are so many large investors that when they invest, it is a small amount for them but large enough to make them lead investor. But they go through so many deals that they don’t seem to be spending time on the terms at all. I’ve heard from one person that they just write off investments that get diluted to nothing or fail, and employ diversified investing across many different investments and hope that a few make it big to cover the many that return little. Very frustrating for us smaller angel investors.

Always be ready to walk away no matter how good parts of the deal looks…

Investors are not aligned with interests of the company in building value.

Clearly stated in Josh Kopelman’s post, it makes sense that as investor I want the valuation kept as low as possible so that I convert to as high ownership as possible. But my model is to help entrepreneurs as much as possible. So if I end up helping them and sign up as advisor, but feel that a Note they may be presenting may not be in my best interests, I may end up not investing at all.

Why I like Preferred Series.

I have ownership in the company.

I gain immediate ownership in the company and this point is not nebulous, as in the situation of the Note.

Generally, preferred terms are pretty favorable to me.

There will be provisions for voting, company control, preference in paying back, potential dividends, etc.

I am aligned with the interests of the company.

Once I have ownership in the company, I can freely and without reservation help the company build value, as my own value in the company will also grow.

Why not Preferred Equity?

Not many reasons to not jump into an investment if Preferred Equity is offered, assuming all other factors are positive.

Sometimes, there is a gotcha in the terms.

Potentially the terms could be not quite right. This happened once where the voting rights were not favorable to the Preferred Series Angel round. I caught this at the eleventh hour and thankfully the entrepreneur agreed to a change in the docs to make this more favorable. Otherwise, our terms and rights could have been wiped out without us having any say in it! You always need to review the terms no matter what and I would do it with a seasoned lawyer who has done many financings before, and hopefully from the perspective of company and investor.

Caveat Emptor – “Let the Buyer Beware” – words to live by and in the investing world you have to dig into every little detail in every deal. It costs more in time and money, but it keeps me out of trouble.

Convertible Notes versus Preferred Equity, Part II: Enterpreneurs

In reading my last post, one may start to think on why either method may be more or less desirable to an entrepreneur seeking to raise cash.

Why a Note?

It is Cheap.

Early stage startups typically have little cash to spend. Closing a Note allows them to bring in money in the cheapest possible way. Preferred Equity will cost them 10 to 20 times more.

It is Fast

Often startups need cash as fast as possible to fund short term operations. A Note closing can be accomplished in as little as two days.

It is Unsecured

For early stage startups, every Note I’ve seen has been unsecured. If the company goes under, there is no obligation to pay the Note holders back. It could be secured by assets, but generally for early stage startups it is not. Why would you get paid back with 1/10 of a PC?

Maximum Flexibility

In the case of early stage startups, we talk most often about a Convertible Note which Note holders want to convert to some version of stock in the company. Depending on how vague the language of conversion is, a startup could convert the Note holders to common stock, to Preferred Equity, or even to the terms of another Note. There is the potential for maximum flexibility on the part of the company as, in theory, it could convert to anything if they word it right. Another aspect of flexibility comes in next financings. For instance, with a Note, valuation for the company has not been set yet so there is freedom to adjust. It also means there are no preferred shareholders and could be more attractive to certain large investors who want more control in the company.

It is Low risk

The Note holder often has an interest in helping the company and getting in on the ground floor, and they can be generous with the payback period and the terms. Assuming the company either gets to a place of generating money or raising more, a Note of this type can be paid off prior to the due date, or converted to preferred in the financing, in which case the Note turns into equity and expunges the debt.

Why not a Note?

Not many reasons to not use a Note first, from the company perspective.

It misaligns helpful investors with the company.

The startup may have some investors whose contacts you want to leverage, or who are actively giving you help. By executing a Note, the startup creates a situation where the investor is not incentivized to help the company. If the company grows in value, and since Note holders don’t have actual ownership in the company yet, then Note holders gain smaller share of the company when the Note converts. Helpful Note holders want to help, but they will see their potential stake in the company if they help drive the valuation of the company upwards.

But read on for some thoughts on Preferred Equity.

Why Preferred Equity?

It aligns the interests of helpful early stage investors with the company.

In Josh Kopelman’s blog post about Bridge Loans vs. Preferred Equity, he explains it well. Once investors jump into a preferred series where they have actual ownership in the company and feel good about building value with the company, as their own value in the company increases with whatever value they build.

It rewards early stage investors with their support of the company.

Early stage investors have the riskiest position. They go invest in a company early, and often they get their stakes diluted by subsequent investments until they get nothing back. This seems grossly unfair for people who supported the entrepreneur at such an early time when there is barely no clear value built yet. With a preferred series raised with the earliest investors, they are rewarded for giving their support early on and the preferred equity will most likely resist dilution with the proper provisions.

It attracts investors.

Like with the previous item, preferred series are just more attractive to investors simply because you gain immediate ownership of the company and not have to deal with potential uncertainty of Convertible Notes. Entrepreneurs can increase their chances of getting more investment by offering this early on. Many investors are gunshy of Convertible Notes and want ownership immediately.

Why not Preferred Equity?

It’s expensive in time and money.

You spend more money executing the paperwork, and there is a lot more paperwork to do. This may be too much for an early stage startup to bear financially.

It could deter future investors.

Venture funds don’t like to have others in potential control of the company. They want it all. Other preferred shareholders could present a problem here as they may have preferential voting rights, perhaps even a board seat. Also, preferred equity terms often have anti-dilution provisions which prevent future financings from grabbing a larger stake in the company.

Operationally, it adds a bit more complexity.

Now a preferred shareholder elected board member may be present, so there may be another voice in the operations of the company. Potentially, other large directional moves by the company may require the preferred shareholders to agree via vote.

Still not an exhaustive list, but some thoughts I’ve picked up along the way. More interesting thoughts in Part III from the investor point of view, coming up next!

Convertible Notes versus Preferred Equity, Part 1.5

Oh one other quick word.

When I started dealing with term sheets in both Notes and Preferred Equity, I strove for understanding. I went in thinking that this was an orderly process and that there were standard contracts for this sort of thing.

The one thing I learned is that NOTHING IS STANDARD.

Terms are written purely on whatever the entrepreneur and the investor(s) want. Yes, there are standard things like interest rate payments or anti-dilution provisions, but as for what interest rate to pay or which type of anti-dilution provision of which there are many…all up for grabs.

So if anyone tells you their term sheet is standard in the industry, don’t believe them. Everything is negotiable, so just say, “Thanks I’ll take a look and get back to you.”

Onwards to Part II…

Convertible Notes versus Preferred Equity, Part I

Just recently the issue of Convertible Notes vs. Preferred Equity came up with an entrepreneur. It was an interesting discussion and caused me to think deeply about both types of financing methods and why entrepreneurs and investors may or may not like either one.

In this Part I post, I describe what I’ve learned about Notes and Preferred Equity. This is by no means exhaustive or even showing that I’m an expert in this, but I choose to state what interesting information I did dig up over the many months I’ve been doing this angel investing stuff.

Characteristics of Notes:

1. They are cheap. I just heard a quote from a law firm that, after terms were set, you could close a Note at about $1000 in legal fees.

2. They are quick. You can close a Note in about 2 days, assuming everybody gets their cash transferred in. If you need cash in a hurry and the other larger financing round is going to take more time to close, then the Note can give you cash in the short term very quickly.

3. The paperwork is minimal. Only one document is required, which is expanded from the term sheet and spells out the terms of the Note in exhaustive detail. Investors sign that, the money is transferred, and you’ve got cash.

4. At early stage, many companies have little assets. Generally, for early stage startups, Notes are unsecured, meaning they are not backed by the assets of the company. So if you go under, you are really under no obligation to pay investors back.

5. It keeps options open for the next equity financing. Valuations may change and the Note doesn’t cause any potential issues with Preferred Equity ownership prior to the next round of financing.

6. Negotiation on terms is possible, increasing time and cost to close.

7. Notes, or convertible notes, are basically loans to the company. The investor doesn’t own any part of the company, and there is a promise to pay back the loan with interest. The convertible aspect means that at some point, generally when the next financing occurs, the money you invest would convert to the terms of the next financing. Sometimes it’s spelled out as to which financing it is, and sometimes it is not.

Characteristics of Preferred Equity:

1. Preferred equity holders gain actual ownership in the company.

2. It locks in a valuation for the company at time of closing.

3. They are more expensive than Notes to close. A recent quote, after terms were set, would cost about $10,000 to $20,000 in legal fees to close a Preferred round (versus the $1000 of a Note closing).

4. Preferred Equity rounds take longer to close. They may take up to 3 weeks to finalize everything (versus as little as two days for a Note).

5. There is more paperwork involved. A Note involves only the expanded Note document. A Preferred Equity round involves a Stock Purchase Agreement, Investor Rights Agreement, filing of changes in the Articles or Certificate of Incorporation, potentially a Voting Agreement, and other supporting documents and changes. After all the paperwork is signed, a Preferred Stock certificate is sent to each shareholder.

6. It will require an official board meeting resolution to approve, and recording of minutes.

7. Negotiation in terms is possible, increasing time and cost to close.

8. Preferred Equity may cause issues in further financing rounds as follow-on round investors may desire more ownership and/or control in a company and may be deterred from investing by the fact that there already are Preferred Equity owners present.

9. Preferred Equity holders get preferential treatment as defined by terms. These can be things like, in case of company liquidation, they get paid back first, or anti-dilution provisions, or special voting privileges, or the ability to select a board member to represent their interests.

In Part II, I look at Notes versus Preferred Equity from the entrepreneur point of view. Part III will look at Notes versus Preferred Equity from an investor point of view.