These last two weeks were a whirlwind with YCombinator happening and then the subsequent meetings with their entrepreneurs afterwards. It was a great event and very tiring and brain draining with 36 companies to listen to. Hollywood was there with a guest appearance by actor turned angel investor Ashton Kutcher and wife Demi Moore.

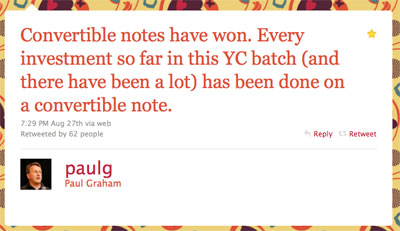

One interesting thing that did happen was that everyone was raising money in convertible notes. Paul Graham tweeted out this fact:

Now, anyone who knows me knows that I hate convertible notes. See all my misadventures with notes in this blog category.

However, once I took a look at their “standard” note, I had to say that, as far as convertible notes go, this was probably the most palatable convertible note I’ve seen to date.

I used to encounter totally barebones notes, but with an option to convert at the next equity financing. Those disappeared as investors started becoming smarter about financing, but, as funding rounds got lower and the cost of starting an internet startup dropped, the cost of doing a preferred equity round became expensive relative to the amount they were raising. This is also changing too as the creation of standard early stage equity round documents has helped this process, but still it was more expensive than doing convertible notes.

Then came the convertible note with a price cap on it at conversion. This eased some issues but didn’t totally erase others; even those notes were still very company friendly in many respects, and I encountered some of these issues with the notes I invested in.

Taking a look at the “standard” YCombinator note that is used with this class, I must say that it is more complex than the standard simple convertible note, but I think it does give a lot of advantages to the investor which other notes do not.

First, it has a price cap on the conversion – infinitely better than barebones notes with no price cap.

Some of my concerns deal with the 5 conditions in which a startup might find itself in, relative to this note. These are, with why this note is better in these conditions:

1. The startup is doing great and is raising their next round at a value above the cap of the note.

Comment: This is the best condition and the cap delivers price advantage. One potential issue is in what terms does the next round enter into. With a good lead, this generally is not an issue.

2. The startup is doing OK but will raise their next round at or below the price cap.

Comment: This is not the best condition for the company given its progress, but we as investors at least get the best price which will be below the cap now.

3. The startup is doing great and is profitable, and the note comes due when the startup doesn’t need financing.

Comment: Here other notes present a situation where they can pay us back and we don’t end up with any ownership of the company. This kind of sucks because we intended on ending up with stock in the company but didn’t get any and only got interest. However, this note has a term where when the note comes due and if a financing has not occurred we have the option to get paid back or convert, and convert into a preferred equity round with terms defined through an attached term sheet. This is the important part: we can convert into a preferred equity round that has pre-defined, balanced terms, and not into common stock or get into a negotiation about preferred equity terms in a situation where we would not have leverage to negotiate.

4. The startup gets acquired before the note comes due.

Comment: In case of change in control, we have the option to automatically convert and take advantage of us owning stock and getting a piece of the proceeds of any acquisition or exit. However, we have the option to also just get paid back, which can be advantageous to situations where the exit would result in us getting less money back if we were to convert to common stock. As investors we can choose the best condition for the situation we find ourselves in.

5. The startup raises their next round, but no one leads and the terms aren’t being set or driven by anyone.

Comment: This is one which I have encountered and is problematic because a qualified equity financing has occurred, but no one steps up to lead the round and drive the terms. If the company is left to its own devices, it will most likely deliver company friendly terms. Currently the note doesn’t quite take care of this condition. In the case of a non-qualified equity financing, then we use the terms as set in the attached term sheet.

I hope that this form of convertible note with cap gets out there regardless of whether we think notes are a trend over doing preferred equity. I think the jury is still out on which form of financing will we do more of. As an investor, I still hate notes and would much prefer preferred equity financing. But I do understand the economic issues where doing notes is cheaper than doing equity…at this time. Other movements in the industry may make this obsolete.

Kudos to Paul Graham and the Ycombinator crew for putting forth a convertible note that is much more friendly and palatable to investors than previous or more common instances of the convertible note.

No matter what entrepreneurs really need to do the math to see how much dilution will happen in all these cases. I have seen entrepreneurs who have delayed the question of ownership by using a convertible note, and then got some unexpected news when they raised the next round and they were diluted a lot more than they thought.

Summary:

Key terms and items in this note are:

1. Cap on the conversion price.

2. Interest rate.

3. Automatic conversion happens when qualified equity financing occurs and we convert into that preferred round’s terms.

4. Investors can convert at their option (on majority vote of investors) in a variety of situations. These are at 1) non qualified equity financing happens, so we can convert to preferred stock via the attached term sheet; 2) maturity of note, so we can convert to preferred stock or get paid back; 3) at change in control then we can convert to common stock before the change in control or get paid back.

5. A preferred equity round term sheet is already predefined and attached to the convertible note, to be used in conditions where we may convert into the company’s equity.

YCombinator and Their Convertible Note

Leave a reply