A few weeks back I gave this presentation to a group of Kazakh entrepreneurs at the Silicon Valley Innovation Center. They wanted to know about US investors, what they look for in investments, how to find them and how to create a situation where they might invest in a startup coming from another country.

While the presentation is geared towards this group of international startups, US startups who are just starting out might find this information useful as well.

Upstream and Downstream

In mentoring startups, I have noticed two things have come up recently:

1. Entrepreneurs keep remarking to me that investors are looking for multi-tens or hundreds of billions in market size. I believe this is one of the results of the explosion of startups we have seen over these last few years, as investors at all stages keep raising the bar for the startups they invest in.

2. Startups at early stage are, more often than not, always focused on solving some singular problem and jumping on the early customer adoption as a sign that there is a business there.

But startups who are solving some singular customer problem still can’t seem to satisfy current investors’ desire for truly huge market size. One possible solution to re-defining a startup project with larger market size, is to use the concept of Upstream and Downstream to expand on what you’re working on to something with a bigger vision, and thus larger market size.

What is Upstream and Downstream?

If you solve a particular problem, then looking upstream means to look at what you can solve that is closer to the customer and what they need to do before they can use your service. Looking downstream means providing solutions for what the customer needs after they use your service. Expanding your capabilities up and downstream means you expand your potential business and market size by that much more.

For example, suppose you are an adtech startup. You help companies serve ads across multiple ad networks.

Looking upstream from the problem you are currently solving, you see what the customer needs before they get to your service. So if you are currently helping people serve ads, then things that need to happen before the ad serving are:

1. Media planning for the ad serving.

2. Campaign creation and management.

3. Ad creation and design, visuals and copy.

4. Landing page creation.

5. Ad network selection.

Looking downstream, what does your customer need after ads are served?

1. Analytics – ad performance results, which targets worked the best/worst.

2. Insight into what ads to run next and where.

3. Landing page results, testing, and management.

4. Post campaign management of ad networks.

5. Ad modifications due to results, suggestions for the modifications.

Now, you are providing a more fuller solution to your customers instead of just one small piece. If you didn’t provide these services, your customers would be forced to use other resources or services from other companies. Some of those might be connectable to yours, some they would have to stitch together by hand or home grown technology. Customers always want to have one place to do their work; multiple solutions complicate things dramatically. Being the one place where customers can do everything is a big advantage for them.

Ultimately, expanding your business both up and downstream is a recipe for world domination. Instead of serving only one portion of a customer’s needs, you instead service all the needs up and down the chain.

Today’s world encourages cooperation amongst companies: expose your data via APIs and share it; use outsourced services to do things you don’t want to do. This may be true for some things, but more and more I am finding that startups need to do more by themselves instead of depending on others. By securing more value internally to themselves, they can then expand their vision to be much bigger, capture more potential revenue, and target a larger market which investors love.

End note: Of course, there are examples of startups doing one thing that have gotten big: SurveyMonkey, Evernote. Remember, these companies started years ago in a world where there wasn’t so much competition. Today is different; there are thousands of startups out there and investors are much pickier. Without a bigger vision, you may not even be able to get off the ground. Work Up and Downstream and make your world domination plan a reality!

The Billions of Dollars Opportunity

Time was, if you had at least a hundreds of millions of dollar market, or up to a billion dollar market in your pitch, that was enough to get you funding. But today, I’ve heard multiple times that even a billion isn’t enough, let alone hundreds of millions. Venture funds are now looking for multiple billions, into the tens and hundreds of billions of dollars market.

Some might argue that VCs were always doing this – what’s different now? Why is this important today?

Early stage venture funds are using this as filter. There are too many startups out there, so why not say no to everyone except those with a believable billions of dollars of market story? The implications of this are, the startups with smaller opportunities will find it hard, if not impossible, to get funding.

Startups don’t realize the danger, and seed investors are starting to wise up. There are too many chasing after too small opportunities to be able to pass this filter. If you can’t raise money, it may be that what you’re working on is too small, even for a hundreds of millions of dollars opportunity.

Suppose you get to some impressive scale, like $1M+ in revenue run rate. As you go for the big round, the current crop of series A funds won’t even touch you despite having strong revenue growth. If your market is small, so is your potential and your ability to “unicorn” is not all that great.

So if you’re raising seed, I would figure out what it is you’re doing if not a billions of dollars market and change it to be one. Investors are always searching for unicorns and it’s best that you shoot for being one from the very start or else you may not get very far in your fund raise….

The Pre-Emptive Bridge

Yes folks, we are a bridge happy funding community. I expect that 90+% of my seed investments will require a bridge, and adjust my expectations and funds to prepare for the inevitable ask. It simply takes too long in general to get to either breakeven or good enough metrics/traction to land the next big round – I estimate now it takes somewhere between 24-26 months to get to either on average. That doesn’t mean there aren’t outliers who do it in less time; it just means that most of them won’t be outliers and will take that long. The problem is that nobody ever raises for 24-36 months – we do see seed rounds edging higher to $1.5-2M rounds over the $500K-$1M we say not too many years ago. Still it’s tough to even push $2M into 24-36 months. If nobody raises for that long, they will most likely come back to us and ask for more money.

Lately though, I have seen startups and investors work better together and do a bridge before they really need it. I call this the Pre-Emptive Bridge.

Usually what happens is the startup looks at when they expect to raise the next round, most likely a series A, and now do it well more than 6 months in advance of that time. They now know there is seasonality in investing, and take this into account, trying to now adjust cash and burn to run out in July instead of December. They try to plan such that they can go out early in a year, say January through March, and start their series A process then versus in the fall.

Then they look at what they will have accomplished by the time they want to start raising their A. Will they have good enough preparation, traction and metrics for the A?

If they do not have good enough preparation/traction/metrics or their cash will run out before they do or cash will run out in a poor time of the year, then here comes the Pre-Emptive Bridge.

They come back to us with the outlook and the plan, and we look to raise some more money to get us to any of:

1. Breakeven

2. Running out of cash in July instead of a poor part of the year.

3. Good enough traction and metrics for a decent chance at an A, and achieving those traction/metrics at a time to go for the A starting in the early part of the year.

In years past, I’ve felt that investors were always caught off guard by the bridge. Now it seems like even angels are expecting it, and it looks like many are prepared to put more money into those with a good plan and likelihood for success. I’m not only glad for this, but also for entrepreneurs to have the foresignt to look ahead that far and take steps to increase the probability of success well in advance versus waiting until the last moment.

[UPDATED] The State of Early Stage in March 2014

A few weeks back I had the pleasure of presenting to the Silicon Valley Innovation Center, an organization which works with many Eastern Europeans on introducing them to and making connections in Silicon Valley. They wanted me to talk to them about the state of startup investing, and I chose to present on the state of early stage investing, the area where I do most of my work.

The events in Ukraine prevented many from coming, but two people did make it to my presentation. The presentation was not an upbeat one; I showed slides from many data sources stating that I believed there were some serious issues for seed investors to operate and profit from. After the presentation, I was surprised that they said I was only the presenter who didn’t have an extremely optimistic outlook on events in Silicon Valley.

Here is the presentation – it is updated to information to late March and is missing some new data that has appeared:

Just to be clear – I have no issue with entrepreneurism. I admire people who start businesses to either make money to support themselves and their families to those who go for the gold. It’s not easy to do, and it’s the Golden Age of Entrepreneurism right now. Nowhere in history has it been easier to raise some money to go pursue the dream of starting a company. Nowhere in history has there been so many resources dedicated to helping companies start. Nowhere in history has there been so much fame and attention assigned to entrepreneurism. You’re a superstar if you start your own company today.

Each day, more and more investors emerge. With the passing of the JOBS Act, soon the normal average US citizen will be able to invest in startups. And we are seeing the appearance of so many new funds. Where are they coming from? Some are angels in disguise, some are family funds, some have international origins, some we don’t really know. Still Silicon Valley is awash with money looking for somewhere to go. We can partially thank the Fed for some of this – holding interest rates at zero, making bonds a non-investment – they’ve pushed everyone out on the risk curve, and investing in startups is one of those places investors have been pushed to.

Each day, more startups emerge. Most startups I meet already have 4-6 competitors – or more. By the end of 2013, we had done our own counting and thought there would be 2500+ startups out there. Unique-ness is a hard competitive advantage to achieve. Raising a ton of money when you have little traction is much easier by far.

Who to pick to invest in? I’ve heard many methods out there ranging from “just pull the trigger if you like them”, to doing a ton of research into the market as if you were putting millions in, to “if so and so is in, I’m in too.” Still, the brutal reality is that risk is way up because it’s so easy to start a startup and thus competitors sprout the moment they are seen on Techcrunch.

Even as risk is up, valuations are also up. At one time, if something was more risky, you’d pay a better price for it. Today it’s not like that with startups. Risk is up but so is their price. The going rate for seed stage startups is generally $5-6M cap on a note, or pre-money, with jumps up to $8-12M. When I started investing back in 2006, the norm was $2.5-3.5M pre-money – there were no notes back then.

Manu Kumar just published an excellent post called The New Venture Landscape. In the section entitled, “Re-jiggering of deal stages and sizes”, he states:

Seed is not the first round of financing any more. In fact after noticing this trend last year, I have transitioned to calling most of my initial investments “pre-seed” rounds, where the company raises close to $500K, before raising a full seed round. The Seed round is larger — closer to and sometimes upwards of $2M. The Series A is now the fourth round of funding for a company — the first is usually friends and family, or an incubator (~$50K), then pre-seed (~$500K), then seed (~$2M), then Series A (~$6M-$15M).

So I can’t even call myself a seed investor any more – we are sometimes part of the $2M “seed” round but more likely we are part of the “pre-seed” round. Even at pre-seed stage, we pay a higher price generally, but yet the company doesn’t raise enough to survive on that alone and usually needs to raise more later (aka the bridge round) to keep going, assuming it gets somewhere at all. Thus, risk is up yet again but there is no reflection of that in the price we pay.

That is why I believe that while this is the Golden Age of Entrepreneurism, it is also grown to be the riskiest place by far for former-seed-now-pre-seed investors. Other stages are not immune to what is happening, experiencing things like Series A Crunch and even the potentially looming Series B Crunch. However, IMHO the issues manifested themselves first at early stage which is where things begin and the other stages don’t feel the issues until much later as it takes years for startups to grow to those stages.

What are the issues?

1. Valuations are up, but yet risk is also up. We are either paying more for a startup at the new seed stage, or in order to get a slight consideration for price we enter the more dangerous pre-seed round.

2. Competition is way, way up. It’s too easy to start a startup, so for us pre-seed investors, how do we know that it’s my startup amongst a group of 4-6 similar startups who will win?

Still, we see those who seek to disrupt the current winners. After Whatsapp’s $19B exit, how many messaging apps have appeared?

3. According to Berkery-Noyes, in 2013 the median of exits is hanging around $12-15M. Contrast that to 2008 when the median was around $20M. Remember also that valuations back then were lower than they are today – startups that exited in 2008 probably started in 2006-7.

When you invest in a startup and the median of exits is less than or equal to 2x that of where most startups will exit, you might be happy with a 2x return in today’s world where our economy sucks and we can’t make money elsewhere. The problem is that your ability to make money is not sustainable in the long run as a startup investor. Your losers will far outpace your winners and investing in startups hoping for a 2x return the median exit will ultimately lead to you going negative pretty quickly.

To give you a look into the failure rate of startups, CBinsights reports that for a given cohort of startups vintage 2009, 75% die, 21% get acquired, 4% are potential over-returners (or the elusive unicorn). That means that you have to invest in 25 startups statistically to get 1 over-returner.

Contrast that to when I started angel investing back in 2006, the venture fund folks I chatted with all told me that if you invest in 10 startups, about 5 will die outright, 4 will either return your money or 2-4x, and then there will be one that will return everything you’ve lost and then some. But that was also at series A stage; there were very few seed funds back then and the seed stage was mostly supported by angels and angel groups.

Let’s play with some scenarios. Assume you put equal amounts of money into every startup you invest. Assume that you invested in 25 startups.

First, let’s apply the current $5M pre money/cap on note metric for funding and assume a $6M post money, and use the low range of median of exits of $12M. Using the CBinsights data from 2009, 75% of your 25 startups or about 18-19 of them will just die outright. Then, 21% or about 5 will most likely return 2x, meaning that you only cover 10 startups worth of investments that failed; you have another 8-9 which still need to be covered in order for you to break-even. That means that one startup which over-returns must do so at 10x to just break-even.

Note that I’ve also made the important assumptions on the 21%. These are:

1. The 21% didn’t raise any more money and you were not diluted.

2. I also assumed that you could actually take into account ownership at the valuation of the round. Most rounds these days are notes with caps and you can’t always assume the ownership is there. In my experience, if you don’t own stock, all sorts of things can happen to your detriment even at a 2x acquisition on current valuation of the company.

I think you can assume that the above case is the BEST case scenario and all other scenarios return less than here for the average person. It also assumes you can get into right deals and not bad deals. Your own investing record can vary widely from the above.

Now for another important metric. By CBinsights count, there were 472 seed funded startups in 2009. In 2013, that count jumps to 856. Again, we are back to more competition with each other and for customers, thereby increasing risk for the average startup that is out there.

How do I cope? Largely, there are three coping strategies:

1. I keep strict valuation discipline.

2. I generally invest only in startups with no competitors.

3. I am always out there searching for the unique, special stuff and looking in places where others are not. I am patient to wait for when items 1 and 2 above align.

(Pre) seed investing has gotten to be an interesting place. I still believe opportunity is out there, but it is largely shifted towards later stages where traction, survivability, and sustainability can be proven, and for investors who can continue to invest throughout the stages of a startup, versus only being able to invest once and either follow on not at all or very sparingly.

NOTE: The strategies I employ at Launch Capital are not necessarily the strategies employed by the other directors.

UPDATED/EDITS: I wrote this post quickly and under uncomfortable conditions! Reading it over I found the need for edits. Here they are:

1. The calculation with the CBinsights data is incorrect. If you return 2x on the 5 acquired startups (21% of 25), you cover 10 startups you invested in. However it forgot to cover those 5 acquired startups so there are 5 additional startups worth of return to cover the 19 dead startups. That means you still have to cover 14 startups, not the 10 I said previously. So the 1 over-returner needs to return 15x just to break even, not 10x. That is even more difficult by far!

2. I said that this was the “best” case. I think this is the wrong word. I think “average” case is a better descriptor. Then my statement about other cases being worse is not quite correct. You can of course return better than 2x in the acquisitions, and return over 15x in the one over-returner.

Biohacking as the Next Opportunity

In early 2013, I had the pleasure of attending the Bulletproof Conference put on by Dave Asprey of Bulletproof Exec fame. It was my first real introduction to the concept of biohacking.

According to Wikipedia, biohacking is the “practice of engaging biology with the hacker ethic.” That means that you use many different means to actively alter and enhance your biology. These could be technological, or they could be biochemical, or they could simply be revealing more on your current biological state so that you can effectively take action. To most people, I think it evokes images of cyborgs and wearing steampunk like hardware on their heads. At one point the hardware may have necessarily looked like that: big, clunky, expensive, wires running everywhere, lights flashing. But today, technology has reached a new level of miniaturization and availability.

I couldn’t resist exploring the potential of these devices. I began training with a specialized electrostim machine called an ARPWave POV with the guys at EVOUltrafit. While the intent was physical results, the training is actually neurological. So while I get results externally, I find that there some amazing benefits internally. I bought a Somapulse which uses pulsed electromagnetic fields (PEMF) to induce healing and to re-energize cells, and was developed by some guys at NASA. I bought it out of frustration that my elbow, which got strained, was not healing fast enough on its own for months. In 3 weeks with the Somapulse, it was all better.

I’ve also tried the various popular fitness trackers and found them lacking. I’m also testing some sleep trackers but nothing comes close to the now defunct Zeo, which I unfortunately was too late to buy one. I also got a transcranial direct stimulation (tads) device called the Foc.us, which I haven’t played with – too many toys! I am also looking into Rife technologies – cure cancer anyone?

I also tried WellnessFX and now am a big fan of more constant monitoring of your blood markers AND the ability to do it without requiring a doctor to prescribe a blood test – direct to consumer still has not seen its full potential but I have seen the value of it. While blood draws may make people cringe, companies like Theranos are changing that to drawing only a few drops of blood (and by the way, 10x cheaper)! I am also actively working with a functional medicine doctor at JustInHealth to get my blood markers back into healthier levels. With my thyroid and adrenals number back in place, every day I have more energy, resistant to disease and more resilient to the stresses that occur in my life.

Much of these technologies are on the fringe still; early adopters and hobbyists messing around with interesting devices, some getting good results, some questioning. It also requires a level of commitment, education, and initiative that most people don’t have. Most people are totally passive on their health and physical condition and just wait until they get themselves into an unhealthy corner before doing something. By that time, it may be too late.

Experiencing the potential of these technologies firsthand and seeing the explosion of such devices across the internet and across crowdfunding platforms like Kickstarter and Indiegogo, I believe that we are on the edge of a new opportunity for startups to create something really new and impactful.

The challenges I see now are:

1. Most of this technology is still complex and requires a lot of effort on the part of the user. Until it is simplified further, wide adoption could be very difficult.

2. The customer base needs to educate themselves on taking control of their health and wellbeing. This will take some time.

3. It is possible that a simpler product could make a customer acquisition strategy work in the short term. One issue I have seen is that companies who have done this do not have the expertise or knowledge to advance their products beyond where they are now.

4. The hardware itself needs work. At the moment, wearing the devices can be cumbersome and uncomfortable. Power requirements limit usage times. Even something as simple as wearing a heart rate monitor belt around your chest all day is annoying. I also think that wireless technologies still need advancing. Bluetooth LE is a step forward, but I find that there are still issues.

The startup who can take a biohacker technology AND figure out the broad adoption problem will really have something. I’ve experienced firsthand the results of biohacking and there is way too much value to not bring to the general population. But for them, it’s a user interface problem applied to super high technology; hide all the wires and blinking lights and make it one button easy.

I’m excited to see science fiction become reality in my lifetime. As a startup investor, I plan to be fully immersed in biohacking technologies in my search for the next winner.

“I’ve Never Heard Of That Before”

In recent weeks, many people have asked me what I look for in startups today. My leading answer has become:

“I’ve never heard of that before!”

As I glance at the flow of accelerator demo day lists and what gets funded on popular news outlets which cover startups, my brain files away stuff that I see. Startups that do this, do that. I may not remember their names but only what they work on or do.

But every once in a rare while, I’ll meet a startup working on something that I’ve never heard of before. I’ll look into what my brain has filed away and can’t even find someone working in a space that is close to it. This is what gets me excited – people working on projects with no competitors.

Back in the old days of venture capital, I heard that lack of competition was something they all looked for. It seemed very important back then as a way to maximize the odds of success. Certainly the world was less filled with startups of all sizes and shapes, which is very unlike today.

However, in today’s world, I see people with multiple competitors get funded all the time. There seems to be the hope that maybe you invested in the winner and not the other guys. When I look, I just don’t know if the startup I’m talking to is going to win, versus the other guys. It just seems too risky to me.

The world is way too filled with things for people to do, or choose from. This affects both consumer and B2B startups. Traction slows down and takes too long for startups to get to break-even or good enough metrics for the next round. When a product or service has other people working on the same or similar things, customers need to process “blur” and need to decide on whether they want to spend time to determine whether something truly is better or not. In my experience, most people just bail – and they wait until enough other people use something before they will even try it.

The only way to combat this is to present something to a customer that they have never heard of before. It must be so unique that the time to process is minimized. That gives them a leg up in acquiring customers. If there is no one else shouting/touting the same or similar product, then they can gain some initial traction without interference from others. They can pull out ahead before someone else gets the idea to build a competitor.

Some of you might think that is nearly impossible to find someone working on a product or service with no competitors. I think that is mostly true; the easy pickings are already being worked on many times over. And yes it’s really hard and takes a lot of patience to wait for an encounter or it’s a lot of work to go looking for them.

It’s the big markets that have not been touched by and disrupted by new technologies that I’m excited about. A lot of that is in unsexy markets, things that definitely that newly graduated college kids will not have been exposed to. Some of them require a ton of time to dig into and understand. Some of them are so unsexy that it requires real effort to fall in love with!

Unicorn hunting is fun and all, but I prefer to look for my unicorns in places where hunters are not. My first attraction to a startup is most likely the realization I have never heard of their product/service before in an industry that hasn’t been worked on yet. Then I rally the forces and dive deep from there.

Hiatus from Facebook and Twitter

Last week I closed my browser windows with Facebook and Twitter in them, and shut down the same apps on my iPhone.

I was fed up. I found myself staring aimlessly at the feeds, scrolling and scanning updates from friends and links to stuff somebody thought I should read. I would waste tens of minutes out of my day, just doing nothing but scanning.

Nice to see what my friends were doing, but I also realized that FB and Twitter also minimized the need to actually see them in real life. I felt like I knew what they were doing, so why bother to try to meet up and catch up when I already knew what they were up to?

The links being sent around were getting more and more purposeless – many were just linkbait, trying to get me to take a look at some fantastic thing, which once you dug deeper was pretty inane and really meant nothing for my knowledge, but only sucked up more of my valuable time to go take a look.

So I left. It’s been a week and an interesting one. There is a bit of withdrawal symptoms there but nothing I can’t handle. But now I find myself doing more real world stuff to fill my time. Stuff like just getting up from sitting in front of my Mac and moving around. Practicing my movement skills: posture, sitting, standing, squatting, sometimes doing some pull ups or push ups, maybe a few one legged squats. Being not confined to the chair is truly refreshing.

I get on the floor and mess around with my kids. They don’t see me in front of the Mac or staring mindlessly at my phone any more. I interact with them, let them climb all over me. There is nothing more satisfying than hearing the triumphant giggles of a child who has climbed from the floor all the way to sit on top of your head!

I read the stack of virtual books in my Kindle – stuff I wasn’t reading because I was mindlessly staring at status updates. How nice to read real writing and not the quick stuff that people just pump out there to get you to click and then make money off your ads…and your valuable attention.

Still I find that while I have not been to either site, I think there is still some value that may make me return. These would be:

1. Friends still message me on FB and DM me on Twitter. If that happens, I should go back to answer.

2. On FB pages, there are the equivalent of groups where I am a member. I may still need to go back to ask a question or reply.

3. Asking for advice is helpful on either platform. I may need to do that from time to time.

4. If I blog, like this post, I can get readership by posting there – assuming that after this post people still want to hear from me even though I’ve largely forsaken these two sites. I have a Socialflow account and can use that to find the optimal time to post a link. So as a distribution mechanism for blog posts, FB and Twitter still work well.

5. The one thing I have not found a great solution for is real news recommender. I went back to Netvibes to see if that would work but so many of the feeds were dead. And there is no filtering there. I am hoping my friends at Digg will revive News.me and get better at news delivery…and not linkbait delivery.

Yes I may go back for some things, but largely, I will not be mindlessly staring at feeds any more, but instead going out there and doing things I really need to be doing, spending time with real people, and enjoying the real world.

Demo Day Burnout

As summer moves on, we are soon back into demo day season for the fall. But yet as I attend these demo days, I find myself getting kind of bored. What do I mean by bored?

They seem so formulaic. The tone of each presenter is the same. Exciting, loud, forceful, confident. The flow of each pitch is the same. There are minor differences: some start with heartfelt stories, all end with graphs rising up and to the right with markets in the billions, and a “If you love [insert appropriate noun/pronoun here], then come find us”. In their attempt to be the best of the best, I am finding that they are all starting to sound the same.

I can imagine what a movie or TV show writer or producer might feel like. These days all you have to do is go to TV Tropes and you can basically find the underlying story line for practically every movie or show out there. This is also why I get bored watching most movies too; it’s the same story but just with different actors and in a different place. Truly special is the time when you stumble upon a movie that someone has done something really different….or perhaps it’s just a trope that I haven’t seen before…?

Somebody should do demodaytropes.com. Then it would just be easier to put together not only each individual pitch, but also the whole show. We could just collect what everyone has done and then you could just look up the demo day trope that fits best with your presenting style and situation.

Of course that would probably just make the whole demo day thing even more unmotivating to attend.

The formula does makes my job as mentor a ton easier. For instance, a few 500startups mentors and I spent many recent days with the startups of the current class to fine tune their upcoming demo day pitches. I sat with some in my mentor hours and went through their decks. There were a few where I actually would rejigger their pitches and then present it back to them in the same tone/style/voice as the many I’ve heard in demo days of the past. Boy, did I sound awesome – well, at least in my own head! I imagined myself acting out the many demo day pitches I’ve heard and just inserted their information and startup name. Almost too easy, right?

Then, when each demo day has 20, 30, no, 50+ startups to present – it’s just getting harder to pay attention simply because of the monotony of the presentations.

Can it get better? I heard that Techstars had loud rave music in between each presenter and one of the startups brought a cadre of supermodels on stage. What else? Any way to make them more interesting beyond the uniformity of their super rehearsed, super confident pitches?

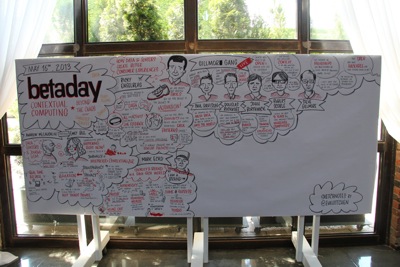

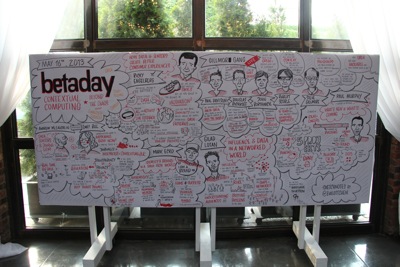

Betaday 2013 Pictures

Some photos from the event – Enjoy!

The Foundry |

View from the balcony |

The crowd eagerly awaits the start! |

Cool glass ceiling |

John Borthwick opening remarks |

Baratunde Thurston, our MC |

Ricky Engelberg, Experience Director, Digital Sport of Nike |

Andrew McLaughlin interviews Emily Bell of Columbia |

Marc Ecko on Unlabeling yourself |

The Gillmor Gang |

Gilad Lotan presenting recent research |

Paul Murphy talks about the HIR program |

Aleksandar Kolundzija on Blend.io |

Kuan Huang presenting Poncho |

Matt Hackett with Teleca.st |

Jace Cooke presenting Giphy |

Patrick Moberg with Dots |

Hackers in Residence 2013 |

Google Glass sighting No. 1 w/ Robert Scoble |

…and discretely using it all day… |

Nick Steele with Google Glass sighting No. 2 |

Betaday concepts captured on paper |

|

|

|

| Last but not least, the ever present GoPro camera which was everywhere capturing time lapse pics  |

|

See my previous post Betaday 2013 by Betaworks for a brief synopsis of the day!