OK I admit it. I hang out mostly in two of the biggest tech startup communities ever, which are Silicon Valley and NYC. So when I blog about what I see, it is most often through the lens of someone who experiences the tech startup/investing ecosystems of those two places and not much of other places (NOTE: I do hang out in Los Angeles a lot too, but haven’t invested much there).

So yeah, I’m a Silicon Valley/NYC tech investing snob and when I write my snobbiness is evident and the facts are biased towards what I see in those two places with respect to tech and internet. Unfortunately, as I’m often reminded by folks, other sectors, and places in the US and the world have much different ecosystems. What are those differences?

1. Availability of capital is not as easy elsewhere. I wrote in my post What Startups Need Most Of Today that startups don’t need more of funding. Well, unfortunately that seems to only apply to Silicon Valley and NYC where for tech/internet startups this is true. For other types of startups, it can be a dry world indeed.

But there is hope. Thanks to Mark Suster who pointed me to A Moveable Feast of Mugs, Maniacs and Masters of the Game – David B. Lerner:

* Not all angels live in Silicon Valley!

* Not all angels are interested in consumer internet companies!

* There are vibrant angel communities in NYC, Boston and in other cities around the US!

* Angels account for 90% of all start-up funding in the US!

* Angels put up $20 Billion a year into approximately 50,000 startups!*

* Friends & Family put up an estimated $60 Billion a year into startups!*

* There are an estimated 225,00 angels in the United States*

* There are currently ~300 active angel groups in the United States*

Source: Angel Capital Association

According to this, perhaps funding IS NOT so scarce. However what makes funding scarce could be:

a. Networking to funding is tougher in other areas. In the SV and NYC, there are so many people investing and working on startups that it’s so much easier to bump into someone who can help you network into a pool of entrepreneurs or investors. I can believe this is much harder elsewhere if the networks are much more spread out or less organized, or startups are just not nearly as common as they are in SV/NYC.

b. The filters that investors put on startups before investing is a more conservative, traditional filter than for in SV and NYC. By conservative and traditional, I mean they want to see revenue and business plans and progress before funding; in SV/NYC, it is more likely that you can find investors to bet on you simply because you’re smart and energetic, and/or your idea is innovative but still has an unproven business model. Again this applies mostly to tech/internet startups; for other sectors, I find that the crowd tends towards the more conservative filters.

c. The experience base tends towards other sectors in other parts of the country. Thus, unfamiliar sectors may find funding very very scarce simply because the investor pool generally likes to invest in things they understand or have prior experience in. Here in SV/NYC, you can find many people who made a lot of money through the internet booms and have extensive experience building internet projects. But these guys rarely invest outside of the internet; so the opposite is true here in SV where if you’re working on something non-tech/internet, you could be very frustrated at seeing all these internet “dipshit” startups getting funded while you, with a really cool non-internet idea, can’t find anyone to bet on you.

2. Following on the networking comment, it is also much easier to get help as an internet/tech entrepreneur in SV/NYC. You can more readily find help here in SV/NYC as the available pool of entrepreneurs and helpful investors is higher. But if an internet/tech entrepreneur goes elsewhere, it could be very hard to find help. Also note that there are places where tech/internet help is building, like the cities where Techstars is popping up. For other sectors, this may be also true in SV since the variety of startups that are worked on here is very great. But for other parts of the country where the concentration of a given sector’s startups may be scarce, it could be very hard to find help.

Help can also come in the form of business contacts. If you’re in starting a company in a place where there are few or no others also working in that industry sector, then you will have to fly to find these contacts and that makes finding help harder.

3. Hiring can be *really* tough elsewhere. It seems the cream of the crop of software engineers ends up in SV with the dream of working at Google, and then some head to NYC area if they like that atmosphere. Generally, around major universities or major metros is where hiring is best. However, parts of the country which don’t have major corporations of a given industry sector or are less desirable places to live (by whatever metric people use to choose) can make it abnormally hard to hire. At least universities seem to be graduating a ton of software engineers; compare that to the number of biomedical, mechanical, civil, nuclear, etc engineers that graduate. Then remove those that are unsuitable for startups, either mental makeup, attitude, life stage, etc., and your pool gets that much smaller. It’s tough enough hiring for tech/internet startups; I can’t imagine what it would be like for other types of startups.

Is there hope for other parts of the country? I think the answer is sometimes:

1. Places like Chicago (Excelerate) and all the Techstars cities are forming their own entrepreneurial centers and incubators for internet/tech startups. But they are the new generation. If you Google a city plus the word “incubator” you can also find many tech incubators already in existence. But those tend towards non-internet tech and more traditional ways of thinking and building businesses, which are different and potentially not as effective for internet businesses. Meetup.com is allowing entrepreneurs and startup people to form little to big networking groups.

However, I am not sure that forming more incubators for internet startups is the right way to go. I have seen startups coming out of incubators that were very similar to other existing startups. I also think that the ease of competitors popping up means that finding something truly unique to work on is getting harder and harder. So somebody has to realize that as they are picking companies. So far, Ycombinator who has been around the longest seems to be picking and directing startups to work on really innovative stuff (and unfortunately there are always those that end up after their brief YC stint with not so exciting and innovative startups or those that are very feature based).

At the very least this suggests to me that new incubators need to do a better job of realizing what environment they are operating in and helping/fostering/directing their entrepreneurs to build really innovative stuff versus stuff that already has competitors.

2. One of the biggest issues I see with doing internet startups elsewhere besides SV or NYC is that while you may think you are working on a great idea, it is highly likely that someone else is already working on it. This is a big problem where entrepreneurs don’t look around the competition hard enough to know who else is working on your problem.

As an investor, I am extremely sensitive to competition in the internet only space. If you are working on something similar to something in SV or NYC, I may naturally pick the one in SV or NYC simply because of the environmental factors that will give them edge over someone who is not in those locales. Outside of internet, I think the world is nowhere near as competitive because it is much harder to create a me-too startup in other industries.

3. I sometimes meet investors in other places who lament that they can’t find good startups to invest in. It seems that they see all this money being made in internet startups (mostly all in SV or NYC!) and they want to get into the game. A couple of responses:

a. Sometimes they don’t have experience in internet businesses. This is a big problem as it increases risk that their lack of experience could mean they will bet on problematic startup plans. In this case, I think it will be better to find a fund to invest in who specializes in internet/tech.

b. Investing in startups not near you brings it’s own problems. How do you keep tabs on them? How do you know what they are doing? Are they squandering your money? You can’t take a ride over and talk to them. Stick to investing in startups you can get to easily, or at least in places you frequent in.

But yeah it sucks if there are no startups near you, or at least not in the hot trendy sector at the time….

c. I still maintain that the risk profile for internet only startups is extremely high even if it seems that people are making a lot of money on them. The ship has, unfortunately, sailed for many opportunities. Newly created internet startups tend to be incremental improvements on existing services, or those that attack a niche market whereas the giants attack the overall market. The success probability for an investor in these startups is going to be really tough. Returns will be lower because many of these businesses are doing cool stuff, but are attacking markets smaller than giants who are attacking the overall market; therefore, the exits on these will be most likely sub-$100MM.

So should you jump in? I think internet is going to be an opportunity trend, just like microprocessors and personal computers (and the list can go on). People bet on these trends and they lasted for a long time but now they have topped out and it’s hard to find those game changing huge bets in those areas. With the internet and its ability to launch things with very little capital, I believe the internet has raced up to topping out and will continue to make it harder to find really game changing, super exits that we all want. Soon it may be hard to even get worthwhile exits in the mid-$10MMs (and by the way, the economy still sucks which further suppresses exits, as well as the lackluster IPO market).

I would say, wait it out. There will be another trend coming soon and you should hop on that. Or find some venture fund to help you get into internet startups but I still think it is an area fraught with peril for venture returns.

So OK, I’m a Silicon Valley/NYC tech investing, blogging snob. And the reality is, where there is easy money, help, community and resources like in SV, NYC, and maybe some other up and coming areas, then startups and investors will flourish. Like for the movie industry – if you’re going to make a movie you wouldn’t go to Indiana right? You’d go to Los Angeles where there was money/help/community/resources for movie making (or maybe NYC). If you wanted to be a music star, you’d probably want to go to LA, or NYC, or if you were a country music star you’d end up in Nashville.

The world isn’t fair. We congregate in a place, make it a mecca for something (startups, movies, music, etc.) and it becomes THE place to go to become successful in it. But we want other places to be like that, like maybe where we are living right at this moment. We don’t want to move; we like living where we’re living now. But the fact is, sometimes the rest of the crowd congregates elsewhere and makes it mecca for something like startups and investing whether you like it or not. Participating from afar really isn’t as effective as just going there and living it.

Monthly Archives: September 2010

The Lack of Due Diligence is Appalling and Foolish

There has been a disturbing trend I’ve noticed in early stage investing. That is when there are no professional investors (ie. venture fund) in the round, then I often find that I am the only guy asking for due diligence materials.

To me, this is appalling. How can you know that you’re investing in a real company? How do you know what has transpired in the past won’t catch up with you later to nip you in your ass? How do you know if you’re just transferring your cash into someone’s personal bank account?

Fallacies:

1. “If all these prominent individuals are investing, then obviously these guys are legit.”

Apparently, in some of the early stage rounds I’ve encountered even with prominent individuals, I’m still the only guys who asked for due diligence materials. So I guess that statement is only a fallacy when I’m NOT in a round since you can be sure I did ask and review them.

2. “If they came through a prominent organization [ie. Ycombinator, Techstars, TC Disrupt winner, etc.], then they must be legit.”

Well, mostly true for some aspects but not others. For example, they may have been incorporated but not had any board meetings, or had their initial founder stock purchase plans created. How do you know there isn’t something beyond the basics that is wrong with them?

Still prominent organizations must do some level of due diligence themselves to protect themselves from liability issues later on. But I will tell you that it is by no means complete or as buttoned up as it should be.

3. “If they say they are a DE corp, then everything must be OK.”

A lot of guys go to those online instant incorporation services and just pay a few hundred bucks to create a company in DE. After reviewing some of them, they are always barebones docs and may not be complete (ie. Articles of Incorporation are filed and generic By-Laws created, but no further docs created like Board Meeting Minutes or Stock Purchase Plans). There is also no advice given on how many shares to create – for example, it is a better practice to create 10MM or so common stock shares to prepare for the future. This WILL create work and costs to fix later on.

To me, it is imperative that you do your own due diligence. I gather materials on every deal and review them with my lawyer. You never know when you might find something that is wrong with the deal.

Here’s an example. I met an entrepreneur who got referred to me by a venture capitalist. I thought that since the venture capitalist was investing, the due diligence would just be customary and there would be no issues. Boy, was I wrong.

First, the entrepreneur didn’t want to give me typical due diligence materials. This was strange. Every startup before this gladly handed over the docs. But he didn’t. I went through several email exchanges with the entrepreneur to convince him that this was standard procedure that it happens all the time. He kept saying that these were confidential and was happy to hand them over AFTER I put my money in. Finally he relented and was going to send me materials. But all this time, my confidence in this deal was dropping like a rock.

Then the kicker was when we were looking at signing me up as advisor. I saw the consideration and it was 1000 shares. Hmmm, I thought, it’s a bit low isn’t it? But then I realized that he had only created 1,000,000 shares of common stock in the whole company. Whoa. This was the second red flag – I could see when the next round would come in and then another venture fund would demand cleanup of the corporation and then there would be a tremendous dilution of my advisor options. In reviewing this, we also realized that there were only 1MM shares authorized but they had allocated out 1,111,000 shares, 111K shares over the authorized amount which is not good that they have not gone through the process of authorizing them.

I ended up not investing on the state of the materials I managed to get, and the reluctance of the entrepreneur to give them to me.

And this also when a prominent venture firm had gone into the round too. They had apparently looked at the materials and decided it was worth pursuing despite the issues. But we have to make our own decisions on the information and I decided to decline because these issues had fallen past the threshold that I was willing to stomach in a deal.

If I had not done my own due diligence, I would never have found these things out.

It is fortunate for us working on early stage that due diligence is fairly simple: the startup has not been around long enough to have more complex due diligence. I could not imagine the legions of lawyers poring through an acquisition of a major company by another. Thankfully we don’t have to do that here.

Whenever I do a deal, I ask for this list:

1. Articles of Incorporation

2. By-laws

3. Lawyer, law firm contact

4. Stock purchase agreements

5. Current employee list, their occupation/function, and bios if possible.

6. Current investor list, cap table

7. Current advisor list

8. Latest product plan

9. Business plan if any.

10. Your latest pitch deck

11. Financials to date, plus projections

12. Site/product performance to date if any, and projections, ie. # of users, sales, etc.

13. Board and shareholder meeting minutes and written consents, if any? Organizational resolutions?

14. Stock option plans and agreements

15. Office address/location

16. What is your website/product/etc.?

If they don’t have it, I ask them to just note that. Basically, this list clearly depicts exactly what I’m buying with my investment dollars.

Remember that buying stock in a company is more than just the guy who showed up with his Powerpoint and demo-ed his product to you. It is an entire operation that encompasses product and people and must follow the laws of the country it’s operating in. Unless you ask for due diligence materials, you will never get a clear picture of what you’re buying with your money.

And given my experiences, depending on others to check on the legitimacy of what you’re buying is foolish. So make sure you do your own due diligence and if you have to, pay a lawyer to help you out.

What Startups Need Most Of Today

What startups don’t need more of:

1. Funding – if you have a great idea and team, you should be able to find money.

2. Smart people – Universities like MIT, Stanford, UC Berkeley and the like, are churning out 1000s of smart people each year. You may be smart, but you’re a dime a dozen.

3. Great ideas – Generally, if you have a great idea, you can get funding. You can even get funding for a mediocre idea if someone likes you. Given the explosion of startups, there doesn’t seem to be a lack for ideas.

4. Effort and Sweat – There is no lack of motivation to build either a company or a product. Given defined problems, there are known paths to building great usable, useful, and desirable products as long as you put in the time.

What startups need most of today are:

1. Experience – most entrepreneurs are young and haven’t worked much in industry. They need business savviness and experience either on their team or mentors who are willing to put in the time to handhold inexperienced entrepreneurs. Of course, entrepreneurs need to be open, willing to hear feedback, and to learn from it.

2. Contacts – Following on 1., if you haven’t been in industry long, then you haven’t had time to network properly. Getting the proper introductions can make or break a new business.

3. Monetization – Every startup needs money, but how to get it? Some of this related to experienced persons being involved and creating a business model; some of it relates to working with a platform to accelerate monetization.

4. Distribution/Customers – Whether you’re a consumer or B2B startup, you need customers. For consumer startups, how do you build a customer base when users are bombarded by invites to “great and new” services and everyone’s attention is drawn in a 100 different ways? For B2B startups, how do you find the right people to talk to in a business and get them to accelerate their process to buy your serivce?

5. Hiring – There are too many startups and not enough people to work in them. This is because every entrepreneurial person wants to be their own founder and are not OK with a small percentage of another company. The fact that not every smart person that is out there is fit for a startup means the available pool of hires drops dramatically.

The persons, platform, and/or organization which solves these problems for entrepreneurs is going to make a killing…!

YCombinator and Their Convertible Note

These last two weeks were a whirlwind with YCombinator happening and then the subsequent meetings with their entrepreneurs afterwards. It was a great event and very tiring and brain draining with 36 companies to listen to. Hollywood was there with a guest appearance by actor turned angel investor Ashton Kutcher and wife Demi Moore.

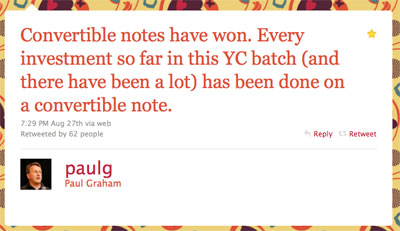

One interesting thing that did happen was that everyone was raising money in convertible notes. Paul Graham tweeted out this fact:

Now, anyone who knows me knows that I hate convertible notes. See all my misadventures with notes in this blog category.

However, once I took a look at their “standard” note, I had to say that, as far as convertible notes go, this was probably the most palatable convertible note I’ve seen to date.

I used to encounter totally barebones notes, but with an option to convert at the next equity financing. Those disappeared as investors started becoming smarter about financing, but, as funding rounds got lower and the cost of starting an internet startup dropped, the cost of doing a preferred equity round became expensive relative to the amount they were raising. This is also changing too as the creation of standard early stage equity round documents has helped this process, but still it was more expensive than doing convertible notes.

Then came the convertible note with a price cap on it at conversion. This eased some issues but didn’t totally erase others; even those notes were still very company friendly in many respects, and I encountered some of these issues with the notes I invested in.

Taking a look at the “standard” YCombinator note that is used with this class, I must say that it is more complex than the standard simple convertible note, but I think it does give a lot of advantages to the investor which other notes do not.

First, it has a price cap on the conversion – infinitely better than barebones notes with no price cap.

Some of my concerns deal with the 5 conditions in which a startup might find itself in, relative to this note. These are, with why this note is better in these conditions:

1. The startup is doing great and is raising their next round at a value above the cap of the note.

Comment: This is the best condition and the cap delivers price advantage. One potential issue is in what terms does the next round enter into. With a good lead, this generally is not an issue.

2. The startup is doing OK but will raise their next round at or below the price cap.

Comment: This is not the best condition for the company given its progress, but we as investors at least get the best price which will be below the cap now.

3. The startup is doing great and is profitable, and the note comes due when the startup doesn’t need financing.

Comment: Here other notes present a situation where they can pay us back and we don’t end up with any ownership of the company. This kind of sucks because we intended on ending up with stock in the company but didn’t get any and only got interest. However, this note has a term where when the note comes due and if a financing has not occurred we have the option to get paid back or convert, and convert into a preferred equity round with terms defined through an attached term sheet. This is the important part: we can convert into a preferred equity round that has pre-defined, balanced terms, and not into common stock or get into a negotiation about preferred equity terms in a situation where we would not have leverage to negotiate.

4. The startup gets acquired before the note comes due.

Comment: In case of change in control, we have the option to automatically convert and take advantage of us owning stock and getting a piece of the proceeds of any acquisition or exit. However, we have the option to also just get paid back, which can be advantageous to situations where the exit would result in us getting less money back if we were to convert to common stock. As investors we can choose the best condition for the situation we find ourselves in.

5. The startup raises their next round, but no one leads and the terms aren’t being set or driven by anyone.

Comment: This is one which I have encountered and is problematic because a qualified equity financing has occurred, but no one steps up to lead the round and drive the terms. If the company is left to its own devices, it will most likely deliver company friendly terms. Currently the note doesn’t quite take care of this condition. In the case of a non-qualified equity financing, then we use the terms as set in the attached term sheet.

I hope that this form of convertible note with cap gets out there regardless of whether we think notes are a trend over doing preferred equity. I think the jury is still out on which form of financing will we do more of. As an investor, I still hate notes and would much prefer preferred equity financing. But I do understand the economic issues where doing notes is cheaper than doing equity…at this time. Other movements in the industry may make this obsolete.

Kudos to Paul Graham and the Ycombinator crew for putting forth a convertible note that is much more friendly and palatable to investors than previous or more common instances of the convertible note.

No matter what entrepreneurs really need to do the math to see how much dilution will happen in all these cases. I have seen entrepreneurs who have delayed the question of ownership by using a convertible note, and then got some unexpected news when they raised the next round and they were diluted a lot more than they thought.

Summary:

Key terms and items in this note are:

1. Cap on the conversion price.

2. Interest rate.

3. Automatic conversion happens when qualified equity financing occurs and we convert into that preferred round’s terms.

4. Investors can convert at their option (on majority vote of investors) in a variety of situations. These are at 1) non qualified equity financing happens, so we can convert to preferred stock via the attached term sheet; 2) maturity of note, so we can convert to preferred stock or get paid back; 3) at change in control then we can convert to common stock before the change in control or get paid back.

5. A preferred equity round term sheet is already predefined and attached to the convertible note, to be used in conditions where we may convert into the company’s equity.