As some of you might know, I was at Yahoo! from 1995 to 2004, running their User Experience and Design team for nearly 8 years and then did a short stint in international before leaving the company. I really wanted to write a book about my time there since I was there from nearly the very beginning. However, I felt that a general historical account wasn’t something I should have tackled, but I could tackle one aspect which I got heavily involved in, which was online advertising.

I started putting my thoughts to paper with a friend who sat with me every week for about 2 years from 2008 to 2010. After that, I spent some months taking her text and reorganizing it somewhat into a narrative. Then, I left it untouched on my hard drive for about 5 years when I dusted off the file again last year in 2016.

With the turmoil that was seen at Yahoo!, I felt it was an opportune time to get this book published! Also, last year saw the rise of a startup called Book in a Box and consultants who could take you from book idea to published, in the event you wanted to self-publish and not go with a traditional publisher. So now that there were resources to help me get this done, I hired a consultant to help me. Always looking to learn, I elected to take the self-publish route and am learning a TON about getting a book written, published, sold, and marketed. I hope to follow up on this experience post-launch.

The book is called Takeover! The Inside Story of the Yahoo! Ad Revolution and takes you through the early days of online advertising, through the dotcom boom and then bust years. My thesis is that Yahoo! developed and drove a lot of how online advertising came to be today. We did a lot of things back then that are pretty mainstream now and probably wasn’t well known that we had explored many ideas and technologies, all developed in-house. I felt that it was finally time to bring this part of Yahoo! to light, just as Yahoo! has finished up its acquisition by Verizon and now is called Oath.

If you want to get updates on the book, go to my book page at YahooTakeOverBook.com, and sign up. As soon as I figure out things, I hope to give a discount code to those who sign up pre-launch of the book. Please go and sign up now and I thank you for the support!

Talking It Up: Launch Capital and Betaworks Voicecamp 2017

“Alexa, turn on kitchen.”

“Alexa, timer set 16 minutes.”

It may seem like I’m talking to air, but I’m not; these are words I utter literally every day to my Amazon Echo in my kitchen. I’ve had my Echo since it first came out and I hopped onto its waitlist for purchase. When it first arrived, it was fun although I really didn’t use its music function all that much. However, things really started to shine when new functionality appeared and when I hooked up my Insteon connected light switches to it.

Now it’s my constant companion in the kitchen and helps me optimize my cooking time. As I race through food prep, I tell it to turn on the kitchen lights. As I dump vegetables into my steamer, I tell it to set a timer for when they will be done. I also set other timers fluidly as I prep other parts of my meal and in the course of moving throughout the kitchen, Alexa is helping me keep track of when food has finished cooking. The handsfree nature of voice allows me to not waste time taking a few steps to the light switch or fiddle with a digital timer on setting the time and setting it running.

It’s this real life experience of what a voice interface can bring that gets me really pumped about voice.

We’ve all seen other voice applications come and go or just not really gain traction. However, with the advent of true voice devices that listen for your command like the Amazon Echo or Google Home (versus Apple’s Siri which requires a button push to activate), the possibilities begin to multiply. I remember my first exposure to voice on Star Trek with its talking computer. But that was in the 1970s and it took until now to bring some of that vision to reality. Better systems and computers to recognize and process voice make real time voice interpretation possible now. However, now comes the really interesting part – how do you deal with the user interface challenges and then build a business on top of that?

As a UX guy, I find that there is inherent elegance in having less physical controls. Like me moving around in the kitchen, Amazon Alexa is a great helper without the need for my hands to *do* anything. And therein lies the challenge of voice interfaces – how can you interpret what I want it to do without me speaking endless complex sentences or memorizing specialized vocabulary? I’ve been impressed so far with Amazon Echo’s capabilities so far, but also wishing for more. In contrast, text-based interfaces via typing have been out there for a while now; however, the interpretation of written language there is less interesting to me than the interpretation of spoken language simply because you need hands to write words. A handsfree interface is much harder to implement properly – the service that does will have a clear advantage over others.

Once you solve the UX challenge, then comes the challenge of building a real business on top of it. Amazon and Google can sell hardware and charge for being on their platforms, but everyone else needs to charge somebody who wants their service bad enough that they will pay for it. Hence, while voice interfaces are inherently context sensitive (ie. you can’t be dictating every email in an open office setting), I believe building a real business is even more context sensitive. Startups will need to find those compelling use cases where voice beats other types of interfaces AND a real business exists, and some of those are known and some are still waiting to be imagined. It’s why we are excited to be part of Volara.ai, one of the few voice startups we have seen with some great early traction in the hotel space.

And we are looking for more, which is why we are delighted to be part of Betaworks Voicecamp, joining as co-investors into each startup of the batch. Betaworks has a great reputation for ferreting out the unique and untapped in startups; we very much look forward to seeing what develops with Voicecamp 2017. If you’re a startup working on voice based conversational interfaces, be sure to apply – the deadline for applications is coming up fast on February 28, 2017!

Finding the Next Big Thing: The Pace of Sector Growth is Fast and Furious

Back in 2011 when I first joined Launch Capital, we started a project to see if we could find untapped markets that would prove to be huge markets and produce huge wins but find them early enough so that we could get ahead of the wave and get our bet(s) in before everyone else figured it out.

While we are still working on ways to uncover untapped markets, one of the interesting things we have discovered is that when a startup appears heralding a new sector, it often is the only entrant for a long time, often for years. Then there is a trickle, and an exponential rise to flood.

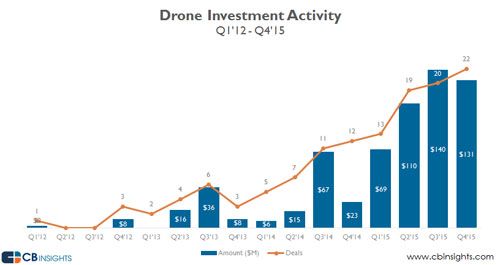

Take the Drone sector, for example. One analog for “hot-ness” of a sector is the amount of dollars investing into it. Here is a graph of Drone sector financing dollars from Q1 2012 to Q4 2015:

Source: CBInsights

Who was that lone drone startup who got funding back in Q1 2012? 3D Robotics, the very first funded drone company, co-founded by Chris Anderson, best selling author and WIRED editor. It was all about DIY back then. 3DR supplied UAV kits and seeded the first self built drones into the marketplace. Let’s call this the “First Contact Phase.” 3DR was around for a year before the next 3 were funded in Q4 2012. Let’s call this phase the “Trickle Phase” where a few more start appearing. It wasn’t until 2013 that a few more drone startups got funded, and then there was a lull until the 2nd half of 2014 when drones exploded into 2015. Let’s call this phase the “Flood Phase.”

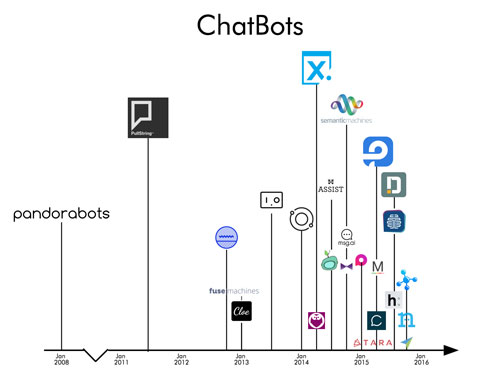

Here is a look at another sector: chatbots. We took a look at the chatbot industry and made a rough graph of startups across time (it’s a tough category because there are many working on bots, and many are working on it inside of other companies. We did our best pulling out those who are solely working on a chatbot):

The first startup appeared in 2008. Then things were very quiet for years until 2014, 6 years later, when things really started to take off. For startups, that is a long time to be surviving. It is possible that without industry and sector hype, there is suppressed availability for revenue and funding.

In either case, in the year before the main take off of the sector, there is a slow trickle of startups, and then it explodes.

When would be a good time to invest, for pre-seed/seed investors like us? Would it be better to invest in the First Contact Phase, or wait until the Trickle Phase happens? Or should we invest into the Flood Phase?

First Contact Phase

The most risky time to invest is when the first one that appears. You have the least evidence of a sector trend taking off at some time in the near future or happening at all.

For example, how would we know that drones or chatbots would take off instead of falling into obscurity or even death/dormancy until market conditions were more favorable? The first startup could try vainly to survive and die because they run out of money trying to create the market.

What drives an investment into a startup like this? It is through factors driven solely by belief. Belief in the entrepreneurs. Belief in shaky market factors that show little or no attraction to their products and services. Your own belief that this could be the next big thing. There is not much other evidence otherwise.

In theory, valuation would also be most favorable given lack of traction and sector trend evidence, although in recent years valuation variance at super early stage has not been all that much compared to others with traction and sector trend evidence.

Competition is non-existent by definition of being first, which does give this startup a unique opportunity to build the market without interference from any other companies.

Trickle Phase

A little bit less risky phase to invest in is investing in the Trickle Phase. You didn’t bet on the first, but now the second has appeared, maybe another few. Still the question remains – “Am I too early?” If you’re too early, some startups will die before the main wave appears; they didn’t raise enough money to survive long enough to catch the wave or were not able to get enough revenue.

In this phase, the market still questions whether these companies are viable and whether customers really want their products or not.

Valuation of these companies again may be lower than when the sector grows, but in today’s world, valuation may not differ much than in the First Contact Phase.

Competition increases as more startups enter the sector.

Flood Phase

And there is the Flood Phase: entrepreneurs, investors, customers, even media are all driving excitement and traction exponentially upward.

Sector trend factors are highest in evidence as many startups enter the field, and investors are putting a lot of money into them. Customers are trying out their products and services in hopes that they will gain the touted benefits.

Valuation marches upward as more conservative investors feel FOMO and must get in their bets on the trend or get left behind. Earlier startups who have managed to survive either First Contact or the Trickle Phase have gained traction and revenue, and later stage VCs invest in those, thus further motivating entrepreneurs to build companies in that sector because it is firmly hot. The media finally notices and posts are abundant about this new trend which adds even more fuel to the fire.

Competition is highest here as entrepreneurs build copycats to those who got funded before, and startups appear to tackle smaller segments of the sector. Investors who believe competition validates the market are validated!

Fast and Furious Acceleration into the Flood

As the title of this post suggests, it is amazing how fast a sector trend can move from Trickle to Flood. If you think about the overall sector I invest in, which is internet/mobile/software startups, it is easy to build something, too easy if you ask me.

When it becomes apparent that investors funding startups in a certain sector, other entrepreneurs also appear. In today’s world where accelerators are pumping out 100+ startups a year, and with the presence of media outlets who cover new startups, it is easy for someone to find a new sector to build something in, build it fast, and get out there for fund raising.

Investors are also self serving; they like to pump up the sectors they invest in for hopes that a Flood Phase will pick their own investments and drive them higher in value.

With software being so easy to write and with so many channels of public information, it basically takes nearly a year for a sector to enter and exit the Trickle Phase and explode into the Flood Phase. A year seems like a long time, but for investors it can take you by surprise. You see some hints, you process. You have conviction about some, you don’t about others. You make some bets, pass on others. If you’re an angel, you may be one of the ones saying “I love you but come back when you have a lead.” Now you’re waiting for other validation which can be slow in coming. By the time you get through all this, it’s already the Flood Phase.

Questions

The two essential questions to be answered for me are:

1. Which phase should we invest in?

I think that the phase you invest in is related to what kind of risk profile you have as investor (which makes sense) coupled with your belief and conviction about the startup and sector trend.

I’ve personally invested across all 3 phases. Of course, I’ve had more failures at the First Contact Phase where risk is highest. You make your bet and keep your fingers crossed. Looking back at my portfolio, the fastest growers have always been First Contact Phase investments.

My Trickle Phase startups have done well, depending on the circumstances.

I’ve made the least number of bets at the Flood Phase. I don’t like it when there is too much competition at the time of investment, especially at (pre-)seed. Valuation tends to be at the upper range which doesn’t work well with our fund economics.

For other investors, I think that later stage works best during the Flood Phase where it can be hard to pick the winner out of a large number of possibles, and it may be better just to wait for the winners to appear out of the noise. First Contact and Trickle Phases are better for investors who want to play in early stage.

The biggest accelerators are best positioned to see sector trends forming, as they see the most amount of startups through their applicants into their batch programs. They also see startups before the startup data companies do, because they only see startups AFTER a funding event happens. In addition, accelerators are often driving sector trends in the sense that they see something worthy of accepting and then media coverage of their demo days pushes new trends out to the public.

2. How do we find the next big sector trend?

This is the essential question that – well – can’t be answered for investors. Why? Because the answers are in the future! How can you predict the future? You can’t! HOWEVER, I think you can take some guesses and chances.

Whenever somebody appears working on something completely new, I look into it. If I never have heard of it before, I will immediately dive in. Unlike 99% of the other investors I’ve met, it is validating to me when THERE IS NO COMPETITION. If there is no competition, it is also possible that these guys are a First Contact startup in a new trend that hasn’t gotten too hot yet.

We’ve also spent a number of years looking into how to find the next big sector trend and, as you can imagine, it’s super hard looking for something that doesn’t exist. We are still trying!

Playing the market like an accelerator also helps; you must have enough conviction and resources to deploy investment broadly and be ok with a high error rate.

Many thanks to Julia Vlock for putting together the research for this post.

Qualities of an Awesome Investor

Some of our team and I were having a chat about what does it take to be an awesome investor.

When I first started investing back in 2006, I was arrogant enough to think that, being a veteran from Yahoo and having worked on so many web products, that I was good enough to invest in internet startups. I thought I could pick well because of my knowledge in UX/design/product, and I could give a startup an advantage because I could help them in UX/design/product. On this background, I set out to try to raise a venture fund in 2006. But LPs kept telling me that while they liked our pitch (fund + accelerator – sound familiar?) and liked that my partner and I were operators by background, they didn’t invest in us because they didn’t think we had enough experience in managing investments.

“Managing investments”….what did that mean exactly? I thought I knew everything I needed to know already! So after a few months of getting the same answer, I stopped raising and went out to angel invest on my own and get this so-called “managing investments” experience.

Years later, after burning through a ton of my own cash, I realized what they meant by “managing investments.” It was definitely knowledge that I DID NOT HAVE even after working at Yahoo for so many years and the experiences I had. But spending a few years burning through a lot of cash and making a lot of mistakes, I now have a better sense for what makes for an awesome investor versus my limited naive view of the world back then.

Bringing it back to my chats at Launch Capital, I then brainstormed a list of qualities which I think make for an awesome investor and what would make an LP want to invest in. Here they are below:

- Track record, increasing IRR, value of startups in portfolio to date. Exits!

- Personal and professional network

- Previous experience, work, hobbies; new experience – what are they immersing themselves into now that is hopefully translatable into something investible?

- Ability to negotiate deal

- Personal brand as it pertains to investing – what are they doing to improve? blogging? speaking engagements? mentoring? etc. etc. it can even be putting personal money into fund(s) to get more deal flow. or getting aligned with a research lab at a university.

- Understanding the ramifications of deal terms

- Presentation and defense skills of a deal

- Proper preparation for a deal

- Due diligence completeness, up to a point (meaning can they decide when it’s not worth it to keep going on DD, or reached point of diminishing returns)

- Exit engineering – hardest skill ever. ability and connections to negotiate and execute an exit

- Deal flow and sourcing – proprietary? unique?

- Breadth/depth of information re: building businesses in typical sectors

- Ability to say no, and being able to say no whenever without any emotion.

- Make hard decisions, like cutting off $ to a startup, or firing someone like the CEO.

- Ability to serve effectively on a BOD. could start with board observer or shadowing a director who is on BOD.

- Ability to smooze a founder and get them to love him/her

- Good intuition in the area of deals, and people. spotting bullshit. knowing when something “smells” right

- Ability to clearly communicate what they are looking for in a deal (knowing that this is individual and everybody will have their own thing – uniqueness here would probably be valuable to an LP more than startup).

- Typical and special skills to help startups with, in breadth and depth.

- Ability to do research fast.

- Responsive to startups and enterpreneurs, and team members. excellent communicator.

- Participate in building brand of the organization in addition to their personal brands

- Ability to spot new trends and not just get excited about existing or old trends. ability to imagine a new trend and defend it, potentially even build evidence for it.

- Hungry to learn, curious about everything. ability to take random topics and become expert at it (enough to be dangerous). loves to read. ability to absorb lots of information from around the world and different sectors and assimilate.

- More optimism than pessimism about deals. optimistic in general about the world. not overeager naive optimism but measured, deliberate optimism.

- Ability to adjust decision process by startup stage versus applying decision critieria to everything

- Being able to work within constraints (ie. $4M pre valuation limit) and find ways to be successful.

- Company evaluation, from product to oppty to financials.

- Discipline to keep to strategy. Intelligence to know when something isn’t working and needs to change.

- Get shit done no matter what!

Having said the above, there is one quality I have found that trumps all of the above – that is….

TRUST.

All you have to do is have the trust of a wealthy benefactor(s) and you are off to the races as an investor. Why do I say this? Look around town. There are a ton of new funds popping up. I have no idea where these people are coming from. Even their experiences were less than mine when I started back in 2006 but yet they have a few million dollars to invest. How could someone like that achieve raising their own fund? It’s because they had the trust of one or more LPs to give them that start. And I have seen some great investors not be able to close their funds, even when their qualities were pretty good on the characteristics above. How can that be? I again theorize its that somehow they have not gained the trust of potential LPs to invest.

What kind of trust are we talking about? Trust that you won’t run away or waste their money. Trust that you will not do stupid things. Trust that you will make them money. Trust that they can find you whenever they want. And so on.

So while you develop those qualities above, which can only enhance your standing with potential LPs, it is ultimately the building of trust that will get their commitments to let you invest on their behalf.

Early Stage Investing Take 2: CBInsights Updates Their Funnel and We Update Our Model

Earlier this year, I wrote Angel Investing at Today’s Market Rates is a Losing Proposition where I presented a model for angel investing and showed that essentially index investing into the early stage set of startups at a market rate of about $6M pre-money put you at a loss after 5-6 years of about 22.6%. It was a sobering result which showed that valuation matters at early stage if you want some chance at making money. In contrast, the break even starting valuation was $4.08M.

Then, CBInsights recently put up a new funnel in their new post The Venture Capital Funnel: Your Chances Of Raising Follow-Ons, Exiting, And Becoming A Unicorn.

For some reason, CBInsights took down their old post and put the new post at the old URL. As a comparison, here is the old funnel based on 2009 data:

Here is the recent funnel:

What are the differences? Note that the recent funnel is built on both 2009 and 2010 data, but more importantly, it is now combined with both seed and seed VC data (we asked the CBInsights staff) which increases the number of startups by 6.4x!

In my previous post, I noted that one caveat about the CBInsights 2009 funnel data:

The CBinsights database is made mostly up of companies who have done equity rounds. Given that the world of seed seems dominated by convertible note financings which don’t show up in the CBinsights database, what does this dataset mean? Equity financings typically include a seed fund or something similar like an angel group. So you can be sure that most of the companies all have an entity behind them to help them with their progress. They have an advantage with this help over those who do party rounds of only angels. Still, despite the help of these funds, the funnel ends up negative for those who invest in these companies at seed.

It took about 25 startups that had a seed VC involved, to yield one potential unicorn out the other end. However, when you add in data that does not include a fund, you now need 115 startups to yield one potential unicorn out the other end!

For those of you angels who think you got something special, this data shows that you are approximately 4.6x less likely to create a startup that makes it to potential unicorn status UNLESS you can get a seed VC involved at some point.

OK maybe you don’t care about creating unicorns. How about just making money? We updated the previous model to include these current funnel numbers. You can download it here.

As you might guess, you are farther from breakeven than before. The model says you will be 35.7% short at the end of 5-6 years of investing. Using the Goal Seek function in Excel, we solved for breakeven in the starting average valuation of your investments. Now it’s even lower at $2.72M pre-money.

Once again we say that this is just a model: one reflection of reality. It also comes with a bunch of assumptions and caveats that still apply (see the second half of my previous post). This model may or may not apply to you, but smartly you should use the insights in your strategies for your own startup investing – and early stage investing just got a little bit more scary.

Many thanks to our principal Tom for updating the model.

How to Ace Your Entrepreneur Class

Last Thursday I had the pleasure of dropping in on the Designer Entrepreneur class over at CCA. My longtime friend and colleague Christina Wodtke invited me to talk a bit about startup investing and help critique some of their recent pitch work.

As I watched the pitches and listened to the students present, I thought back to other classes I had helped in and realized that it might be useful to put down some thoughts on how to do well in a class that supposedly teaches you how to be an entrepreneur. Here are some tips to ace your next entrepreneurism class and some of them may not be what you might think:

TIP #1: Find out how to get an A in the class.

When you start the class, ask the teacher, “How does one get an A?” Hopefully your instructor is organized and thoughtful enough to be able to give you a clear answer (be very WARY of those who cannot articulate what the grading criteria are – and yes you may meet some of them at your university!).

Write these down, and pin them on a wall where you can see them every day. These are your points of focus. NOTHING ELSE.

If you go off this focus, you risk not satisfying what your instructor told you they wanted and that you don’t satisfy the requirements of the class and therefore, won’t get a good grade.

That’s not to say that you couldn’t get a good grade by going off path. It just means you may need to work A LOT harder to do so.

TIP #2: You should pick a project that you can complete in the time period of the class.

Be very aware of the duration of the class, whether it’s a 3-4 month class or a year long project class. Figure out what it is you need to accomplish to get an A, and then find something to work on that enables you to complete the assignments by end of the class.

Creating a viable business requires that you find the right idea to work on in the first place. Discovery of the perfect or a viable idea can take a long time. You can spend some time in ideation of this idea but I would recommend doing that BEFORE you start the class rather than spending time in class coming up with something to work on.

Validation of the idea is also possible, but it could be time consuming and you could easily end up finding out that your idea was the wrong idea to work on.

In the CCA class, I gave them my Minimum Viable Product (MVP) vs. Minimum Viable Company (MVC) speech. It may be easy to crank out MVPs thinking that you can get somewhere, but entrepreneurism isn’t the search for MVPs, it’s the search for an MVP that can turn into MVC and hopefully one that is fundable.

Keep that also in mind as you pick the project you want to work on.

Don’t pick an idea that requires a lot of development time. Working on something that requires a ton of new research? Bad idea. Working on something that has a long manufacturing time (ie. building a new car from scratch)? Bad idea. Quick software app? YES- Great idea!

No matter what, you should try to pick something that allows you to satisfy the class requirements by the end of the semester or year.

TIP #3: You don’t actually have to build a real startup to get a good grade.

But wait, Dave, how can that be? Isn’t this a class in entrepreneurism?

A mistake I see many students make is thinking that they actually have to build a business by the end of class. I think this is actually false. In fact, trying to do that within the time period of a class can be a big mistake.

Why? It’s because building a business takes time. Figuring out what business to build takes time. You may not have time to build a traditional fundable startup by the end of the class period.

Remember to keep your eye on the ball – what is the main purpose of this class? It is for you to LEARN/EXPERIENCE THE PRINCIPLES OF ENTREPRENEURISM. I would not sign up for a class that required you to build a real startup at the end of it. Why? Because you never know how much time you need to validate your path. You may need more time than the class can give you. You may actually end up with nothing at the end. Many entrepreneurs spend their life looking for ideas to work on and not get anywhere; others happen on one instantly, if not magically or by luck or chance. You really don’t know which category you’ll fall into.

Therefore, it may be that if you show that you’ve learned the principles of entrepreneurism properly, it might be on a fictional business idea that may never survive the real world, but can show your instructors that you’ve mastered the material.

TIP #4: You may consider building a smaller business.

You don’t need to build the next Facebook to get a good grade. You just need to show that you learned the components of good entrepreneurism. It may be possible to do more complete-able projects in the areas of small business like building a new cafe or retail storefront. The principles are the same even if some of the dynamics are different than a typical internet/software based startup which are more popular today. But having more available data to work with makes things easier.

The more ambiguity/uncertainty/unknown there is, the more riskier it is to use this project in a class setting. The funny thing is, these traits are often those of a wildly successful startup outside of a class setting. The reality is that these projects often take a lot more preparation and thinking to bring to a fundable, pitch-able state.

TIP #5: Don’t fall into the product trap.

As a student, you’re probably been entrenched in learning how to build stuff. Whether it’s coding or design, you’ve probably spent the last few years learning everything you need to learn how to build anything. Despite being awesome as a builder, you may not be anywhere near prepared to be an entrepreneur. Startups are NOT all about product as you might think.

Touching on the MVP vs. MVC comment above – I re-quote Steve Blank again:

A Startup Is a Temporary Organization Designed to Search

for A Repeatable and Scalable Business Model

[source: Nail the Customer Development Manifesto to the Wall – Steve Blank]

I think a lot of people have fallen into what I call the product trap. It is this mistaken belief that if you build something, somebody will buy it. While this may be true for some things, for the most part it is not true.

This is why Steve Blank likes to say that startups are on the search for a business model. They are NOT on the search for a product.

A few years back I helped out in a Stanford d.school entrepreneur class called LaunchPad. I loved their criteria for an instant A – you had to get one person to pay for your product. I always felt that accelerators should force their companies to do that by demo day. It was a forcing function that made sure that teams weren’t just building things but that people actually would give up money for their products – or they actually have the beginnings of a real business model.

So be careful as you go through your entrepreneurism class that you don’t get so enamored with building products that you forget that building a startup is about building a business, and not just a product.

TIP #6: If you are required to build an investor pitch, pitch the business and sell it. Toss anything that is extraneous out of the pitch.

In every pitch I heard, there was an emphasis on product process and what they discovered, and how they got to where they were.

It confused me, and I had to ask the context of their presentation – who was their intended audience? Was it an investor? Was it the instructor? Was it a thesis review board for your degree? Without knowing that I could not fairly judge whether they were presenting the right information or not.

But when they said they were pitching an investor, then I could respond with the appropriate comments. I told them that their pitches sounded like an end of year presentation to their instructors where they showcased what they learned. In fact none of the pitches had discussions about business models, and seemed to showcase their products only. Good for a project class maybe, bad for an investor pitch. Don’t mix the two!

TIP: #7: Establish your assumptions or points of view and execute on them.

In the context of a class, it is sometimes possible to establish what design schools like to call “your point of view.”

When I was at Stanford, they taught us to always establish our points of view whenever we do a design. This provided context and constraints in which our design was created, and allowed us to judge the final product within that context and constraints. If you were open ended or had a poorly defined point of view, then we could never know what you came up with satisfied design requirements or not. It usually ended up being yelled at by the teacher in front of your class, which you get used to pretty quickly in design school.

I believe you can do that with a startup project as well, and especially if you’re in a design school where this is familiar. Remember again, the goal is not necessarily to create a fundable startup by the end of class. It’s to show you learned the principles. And the more you bound your problem statement, the more able you are to complete a successful entrepreneur class project in the allotted class time.

As an example, one of the class projects at CCA I saw was related to doing a traditional business in a better and different way. That was a pretty strongly stated point of view – GOOD. However, when they finished their pitch, it was not clear they had executed on that point of view – BAD – it looked to me that their business strategy was pretty much the same as it always was.

If you follow the above tips, I am sure you will ace your entrepreneur class. Remember always that a class setting is a subset of the real world, a simulation at best. You play by its rules, and you’ll win. You’ll have learned some really important parts about being an entrepreneur and had the opportunity to experiment in a setting with guidance and mentorship. HOWEVER…

END NOTE # : Some of the most important parts of entrepreneurism can’t be taught in a class.

It is not easy being an entrepreneur, but yet in what we read and what we have people tell us, anyone can be an entrepreneur. But that is simply not true. Most people just don’t have the essential traits, or they are too risk averse, or their current lives just don’t enable them to let go of their steady lifestyles to pursue the dream of starting a company and its accompanying chaos.

I have often said that Entrepreneurs are to the rest of the workforce as Navy Seals are to the rest of the Navy. Can you see the difference I mean? They don’t put potential Navy Seals through their demanding training program for no reason – they are trying to weed out those who do not have the mental/emotional/physical traits that enable them to be real Navy Seals. It is the same with entrepreneurs.

This is something that can’t be taught in school. Somehow you just need to have had the right life experiences to become such a person.

Do some REAL DEEP soul searching when you leave your class. You have some good tools to try out in the real world, but don’t be that guy who quits when the going gets tough – you should have never started in the first place… and by the way, that’s OK.

Early Stage Marketplace Investing

One of our Launch Capital staff, Ed Coady, pinged me the other day regarding marketplaces and asked me how does one find the next big marketplace startup at the seed stage. We both remarked that there are a ton of posts on marketplaces and what makes them successful – BUT they are all written as if the marketplace actually has traction. In stark contrast, there are practically no posts written on how to evaluate and pick the next big marketplace at early stage when there is no traction.

For example, some funds will invest in a marketplace when they get to $500K-1M monthly gross market volume (GMV) . But, as a startup, how do you get to $500K-$1M monthly GMV without a series A? And how do investors pick the next one that will get there BEFORE series A?

Those who know Launch Capital know that we invest in early stage where startups are often missing traction, revenue, product, or any combination of the three. In fact, although we call ourselves seed stage investors, we have really moved to what people now call pre-seed, where it is more typical that all three elements are missing and we are only betting on the idea and the strength of the founders. If those are the only knowns, then how does one pick a marketplace play that will be successful?

Ever since I joined Launch Capital, I’ve been looking at marketplaces in a variety of industries. Here is what I look for in a marketplace for investment which will give it the best chance for success, either reaching breakeven or metrics good enough for the next round:

The marketplace must have no competitors.

I am OK with old traditional, offline competition. However, I don’t want to see another startup or three or ten working in the same space. Competition for customers is fierce and with too many things competing for our attention, sometimes everyone becomes your competitor. Thus, it is much better to be the only one in the market trumpeting a service and solution to your problem. Customer acquisition becomes so much easier when there is only one solution available. When there are many, customers need time to decide and this slows down the adoption process. Lack of speed is death to the early stage startup! They need revenue as soon as possible or else their bank account will empty before they reach breakeven or metrics good enough for the next round. Thus, I have found that lack of competition is potentially the most important criteria for early stage startups to have in order to be successful. With today’s crowded startup world, most projects we meet have many competitors – all the obvious stuff is being worked on ten times over. When we find startups that lack competition, this often leads to untapped, unsexy markets where I need to spend a lot of time researching the industry and learning about it. In effect, I need to work to fall in love with something that is unsexy!

The market itself must be believably big, in the tens of billions of dollars at least.

This provides not only the biggest opportunity, but also it provides something attractive to other investors who are also looking for big market sizes. When you step into untapped, unsexy markets, it’s amazing how big they are and how many are still out there that are untouched by today’s entrepreneurs.

Generally for today’s early stage marketplaces, I like to see margins be 25% or greater.

Margins that are small require tremendous traffic to get to any meaningful monetization. It’s just too hard for startups to reach scale without significant amounts of capital now so I like to see some survivability built into their model by enabling a larger take for each transaction. Note that high margins are tough in marketplaces; more than likely there will need to be some specialness to the marketplace that will enable it to justify higher margins to its users.

However, if the transaction size is large (like in the thousands of dollars or more), then I’m ok with a lower margin. Certainly I like to see larger margins whenever possible, but I am more forgiving on lower margins realized on large dollar transactions. This is more often seen in B2B marketplaces.

The marketplace must have figured out a believable lock-in strategy.

Often entrepreneurs will enable the first transaction, but there is the possibility that subsequent transactions will not happen on their platform. I think this is extremely risky and could leave a lot of future dollars off the table. It is much better if the marketplace has figured out a believable way to incentivize both buyers and sellers to keep using the platform so that they can continue to monetize hard-won users.

I like to see that the founders have depth in the industry their marketplace operates.

Too many founders think there is a problem in an industry but have no real world experience to validate it. Or they lack business contacts in that industry which could give them an advantage in gaining business usage of their platform.

If they have traction when I meet them, even better.

Using the above decision process, I’ve invested in 8 early stage marketplaces over the years. 4 are doing amazingly well; 2 are too early to tell if they will be successful, and 2 are questionable. With 4 out of the 8 doing extremely well, it seems that something is going right!

Spotting the next successful marketplace is not an easy task. It’s always easy to write about how marketplaces get big AFTER they get there, but it’s not easy to find them before they are anywhere. There is still opportunity to build big successful marketplaces but they will most likely be in places where few tread but yet are still big markets.

Angel Investing at Today’s Market Rates is a Losing Proposition

A few weeks back, I wrote a post entitled The Tweetstorm that Spawned the 10,000X Startup where Dave McClure of 500startups lamented about the state of early stage, that valuations were way too high, and that early stage investors will lose money.

But, really, how risky is seed investing in today’s world? Are we paying too much for early stage startups?

Over the years that I’ve invested in early stage companies, I’ve heard numerous claims that valuations should be this or that, and if they are not, we will lose money. But I have never been presented with a model or math to show that this or that was true or what would happen if you were to invest at certain valuations.

So with one of our research team members, Tom, we set out to build a model using today’s data sources and see what would come out of it.

First, we took the famous CBinsights Venture Capital Funnel, which is a great way to show the path of startups through their lifespan to future funding rounds, M&A exits, or a death or self-sustaining state.

Then we melded that with data from PitchbookVC’s latest 1H 2015 Venture Capital Valuations & Trends Report. There is some really great information on current valuations, rounds, and exit values there, and we used the median values to model where most of the activity would be. Thus, the following analysis looks at what returns would look like if your portfolio performed at that median level.

Dilution via option pools is also in the model, although we estimated the numbers based on our own experience.

The model itself is available for download here.

You can set the investment amount, portfolio size, and pre-money for the seed round.

On a relative basis, the investment amount doesn’t matter as the resulting return percentages and multiples will be the same for any amount you enter. For the purposes of this post, we entered our usual $150K investment per startup.

Entering the portfolio size does matter as it shows the quantity of startups you’d have to invest in, at a minimum, to yield startups out the other end of the funnel. For example, to exit the funnel with at least one remaining startup who has gone through 6 full rounds of financing, you’d need a minimum portfolio size of 25.

The pre-money inserted in the model is $6M, which is the typical market rate seed round valuation you’d find out here on the West Coast.

If you invest into rounds at the typical market rate valuation of $6M, you are essentially short by 22.6% after your cohort goes through 5 years of life and 6 rounds of financing.

If your portfolio is large enough, the model calculates that you still need to make a multiple of 5.65x on your last remaining startup in order to make back that 22.6% shortfall and break even: a tough goal under any circumstances. (Note that the bigger your portfolio is, the more startups you will have out the end of the funnel. However, to breakeven, you will need to make back 5.65x per startup that is remaining. For example, if you have a portfolio of 100, then you’ll be left with 4 startups remaining, and you need to make back 5.65x on each your startups, or 5.65 x 4 = 22.6x on only one of those startups.) For most angel investors, having enough cash to create a large enough portfolio to have a chance at breakeven or even do better is very difficult.

If we take this model as-is, investing at today’s market rates as an angel investor sure looks like a losing proposition. Of course, any investor worth anything would be arrogant enough to think they had what it takes to beat the market and this model. Let’s dive further into the model.

The CBinsights database is made mostly up of companies who have done equity rounds. Given that the world of seed seems dominated by convertible note financings which don’t show up in the CBinsights database, what does this dataset mean? Equity financings typically include a seed fund or something similar like an angel group. So you can be sure that most of the companies all have an entity behind them to help them with their progress. They have an advantage with this help over those who do party rounds of only angels. Still, despite the help of these funds, the funnel ends up negative for those who invest in these companies at seed.

Note that the majority of financings out there aren’t even taken into account here, which are note financings. I’m not sure one could make the argument that note financings are better than equity financings when viewed across the entire set of startup financings. So you’d have to be at the very least able to invest only in rounds that are also supported by a strong seed or angel fund to be on par with the results of this model. But as the model shows, it is not enough unless you are able to move the odds of successful outcomes in your favor.

What is this model a representation of really? It’s an index fund of startups who got equity financings; if there was a mutual fund that allowed you to do that in 2009, this is what would have happened, assuming the fund could invest in every startup that got an equity financing. You would have lost money for sure. So “spray and pray” is a terrible strategy if you are just investing at market rate valuations. If you could “spray and pray” at much better valuations, the model results in positive returns – think accelerators where they deploy very little money for large chunks of their companies at very low valuations.

Despite the bleak overall outlook of the model, we dove into some of the more prominent seed funds to see how they performed against this model. For example, First Round Capital was a fairly large seed fund back in 2009. According to the same methodology used to build the CBInsights funnel, they managed to have 33% of their 2009 cohort exit via M&A versus the 20% level assumed in the model; they also showed consistently higher follow on rates. Obviously they are doing something right, and better than average.

What are better seed funds doing that make them so great? Pandodaily wrote a post entitled Why Jeff Clavier Insists There’s No Series A Crunch which has a good list on what Jeff Clavier does to help his portfolio companies and take them to success. So there is ample support for being able to invest in rounds which include one of the strong seed funds out there.

Bear in mind what I mentioned before – the CBinsights funnel ALREADY assumes you are investing alongside a seed or angel fund. The likelihood of that happening is pretty difficult, unless you are doing a lot of work to become friendly with the seed funds. And then, not all seed funds are alike; some are definitely beating the funnel in returns but there are many that are lagging.

Suppose you had a portfolio large enough to result in some startups surviving past a 6th round of financing. Our model says that with a portfolio of 25, you’d have one left, and you’d have to make at least a 5.65x to come out positive on your portfolio. With a larger portfolio, there would be more companies surviving after the 6th round to return money and then some; in today’s world, it is likely these would be the unicorns of legend.

Ordinarily, we would all celebrate the unicorn-esque status of one or more of our portfolio, on their way to great heights and potential IPO. However, consider this recent post by Tomasz Tunguz of Redpoint Ventures, The Runaway Train of Late Stage Fundraising. These late stage financings seem to be a current fad and are proliferating while the number of IPOs languishes. However, one thing that is not talked about much are the terms in which these financings are done. A recent post by Ben Nasarin entitled Big Valuations Come with Dangerous Small Print highlights the problems that come with late stage financings. You can guarantee there are many preferences (see liquidation and participating preferences) in the distribution of exit capital. You may end up in a situation where the company seems to exit well, but the preferences result in little or no capital being returned to early investors; that includes an IPO situation (see Ben’s post regarding the Box IPO). While unicorns are definitely good for bragging rights in a portfolio, they may not return as much capital as you like, or need, to breakeven or make money.

The presence of preferences which could stifle your returns requires you to really think through what your strategy might be for dealing with these situations. It may mean you would take the first opportunity to sell your shares at a secondary offering, for example, and take the early exit versus waiting for something bigger later that may never come (In stark contrast, late stage investors nearly always make their money back even in a losing situation).

This model doesn’t take into account follow-on investments, which is true for most angel investors and non-fund entities who don’t have the resources to follow on. So we only account for one investment at seed and no more investments afterwards. Mark Suster has done a great job showing how Founders are diluted in subsequent rounds, but this topic hasn’t really been tackled when talking about angel/seed investors and plays heavily into understanding returns. Preliminary looks at follow-ons increases the deployed capital substantially and take you further from breakeven. Following on precognitively in only the winners does help – ESP anyone?

One might ask – couldn’t we calculate actual exit results from information in their database? Unfortunately not – of the 2009 dataset, there are exit values for only 9 out of the 49 total exits that year. M&A numbers are still pretty secret overall. The best we can do is insert median exit values as a proxy.

The Dead/Self-Sustaining number/% is a bit deceptive. Some of the companies in this number that are surviving could be big companies who simply didn’t need to raise another round, and digging into the companies that did not raise a large number of rounds is needed. Also, indication of death in the CBinsights data unfortunately isn’t all that complete at this time- yet another place for improvement in the data. However as time passes for the 2009 cohort, we should see the final results of those surviving companies.

In examining breakeven, I asked the question, at what starting valuation could I break even according to the model? Using Excel, I calculated the break even valuation to be $4.08M pre-money. Unfortunately, with current West Coast market rate valuations for seed stage startups hanging around $5-6M, you’d have to do something very special to be investing at $4.08M pre-money. Investing at lower than $4.08M valuations means you’d be positive with the model – great job finding startups that early and negotiating awesome deals!

We then compared this model to investing in the public stock market. Using a Cambridge Associates report from last year, we used their calculated return multiple from 2009 for the Russell 2000 (they have a proprietary method for calculating a return multiple to compare your investment in venture capital and private equity against other traditional investments). In order to match the return of investing into the Russell 2000, your last startup must yield a 19.4x! So you would need a 5.65x return to merely break even, but an additional 13.75x to beat investing in the public markets, which is by far a safer investment than startup investing. Why was I angel investing again…?

Using the median values doesn’t appreciate what you might individually do or what actually happened for each round and any preferences that may come with a round. We just made the assumption, right or wrong, that most things would happen at the medians of all the values.

The model is just a model. A reflection of reality, yes, but still not reality. It still communicates some interesting things about today’s investing world and how you might alter your strategy in investing to beat the model.

The Tweetstorm that Spawned the 10,000X Startup

This interesting tweetstorm by Dave McClure caught my eye. It was regarding entrepreneurs not wanting to accept a 2x return clause on notes and the high valuation caps on those notes that are running around the Silicon Valley right now. Then at the end Sam Altman of Ycombinator jumps into the fray, who replied:

.@davemcclure just worry about trying to make 10,000x sometimes, and let founders who work really hard for years w/small exit keep the money

— Sam Altman (@sama) March 11, 2015

When our research team and I saw the 10,000x, we thought we’d have some fun with it.

Wow – 10,000x. That’s an over-returner for sure – probably the unicorn to end all unicorns. But how would you get one and would anyone have experienced one already?

Let’s do some back of envelope calculations. Assume you’re a seed investor like Dave. You could take companies in the unicorn club and divide their current post-money valuations by 10,000. This would theoretically determine what their seed valuations needed to be in order to return 10,000x for the company’s early angel investors.

But then, you’d have to take into account the dilution that occurs by the time a startup is a unicorn. Our principal, Tom, built this ownership model to show the typical ownership dilution each round experiences on its way to series E.

You could stand to lose 50% of your ownership, assuming nothing else bad happened funding wise along the way, on the way to unicorn status.

Let’s take Uber. It’s valued at $40B right now. If you take $40B and divide by 10,000, you get $4M. But then divide by 2 to account for the ownership drop and you’re left with $2M POST money. Essentially this is the valuation of a seed round you would have needed to invest into in order to achieve a 10,000x at the $40B valuation.

Back to Dave’s twitter rant about high valuations pervading in the Valley. Does any reader of this post think they can get in on a high flying, unicorn-esque startup in today’s world at $2M post money valuation?

Still, has anyone ever even achieved a 10,000x? Uber is worth $40B, but its exit story hasn’t been written yet. We poked around and came up with Peter Thiel’s reported $500K investment into Facebook at a $5M valuation. It makes sense on paper that at $5M seed valuation you’ll get a >$104B exit – that’s 20000x! Unfortunately, he must have suffered some dilution and/or sold off stakes early because he arrived at the IPO with an awesome return of 5000x! Dang – only halfway there.

OK 10,000x is a worthy goal. But what’s the odds of you getting that kind of return?

Cowboy Ventures’s Aileen Lee wrote in her infamous unicorn post, Welcome To The Unicorn Club: Learning From Billion-Dollar Startups that she found that since 2003 to the date of the post in 2013, there was a .07% probability of a startup reaching unicorn status. Remember, that’s .07 PERCENT, which means 7 out of 10000 startups have reached unicorn status. Pretty long odds assuming that you even had a shot at investing into one of those pre-unicorns.

Looking back at my investing past, I was scheduled to meet with Uber (what was then Ubercab) but was one of the last investors they talked to. The round was oversubscribed, and I was shut out. I was there at YC when Airbnb started out but sharing rooms in my home wasn’t something I personally believed in, so ultimately I didn’t pursue. I was also there at YC during Dropbox’s demo day. I was in the running for investing, but yet again was shut out as other larger and more prominent investors pushed me out. For every other unicorn, I never even had the chance to even review the deal, let alone invest.

But from what I could remember about Uber, Airbnb, and Dropbox’s funding valuations – sorry about my very fuzzy memory, but those were the days when $4M pre was still possible – I don’t think I could have achieved a 10,000x return coming in at the seed round – maybe >10x, maybe even in the 100x range but definitely not 10,000x.

By now, you may see how absurdly rare a 10,000x is, potentially even unachievable. So what are Sam Altman and Dave McClure really talking about?

It’s the golden age for entrepreneurs. Entrepreneurs have all the power. You can go raise seed at valuations higher than anytime ever in history. New investors on the scene are naive; they haven’t had the history of investing in less bubbly times. They are forced to take whatever deal is in front of them. They think these valuations are normal. And with small checks, they have no ability to affect the terms of the round. But the first naive seed investor that pulls the trigger inadvertently validates the terms.

But the risk is also higher; competition abounds and there literally is an app for anything. So investors pay more for higher risk. It’s also why those who know me, know I like to say that the seed market is bubbly and that it’s the worst time to be a seed investor with no dry powder to follow on. Angels and funds who only invest in seed rounds take all the risk yet get lower/no returns if a company goes unicorn-ballistic through severe dilution. This risks their ability to break even or make money at seed investing.

Entrepreneurs win no matter what the outcome. As many have replied on Twitter to Dave and Sam’s tweets, even a small win is notable or even life changing for the entrepreneur. It is not a bad thing to get acquihired into Google or Facebook, right?

Dave is probably the only guy out there willing to publicly say something about the current attitude of entrepreneurs. The rest of the investor crowd needs to toe much more lightly and quietly; it’s too easy to be shut out of deal flow. Who wants to be shut out from Ycombinator demo day? The entrepreneur forums are quick to denounce investors who are too this or too much that. You don’t play by entrepreneurs’ rules nicely, your reputation is shot, and you’re blackballed from deals.

High valuations at seed are all over the Valley. Market rates for the average SF Bay startup are probably around $5-6M cap on note (forget equity rounds), with jumps to $8-$12M for those coming out of Ycombinator. These are for startups with little or no traction. Market rates for startups with traction at seed can head towards $8-$10M.

If you’re moonshotting for 10,000x at a $10M valuation, you’ll never make it. That’s a >$100B exit valuation for the company, which is at the black swan category for companies like Facebook and Alibaba: outliers by a *wide* margin.

Speaking of black swans, in Sam’s post Black Swan Seed Rounds, he states:

Great companies often look like bad ideas at the beginning—at a minimum, if it looks great, the seed round is likely to be overpriced, and there are likely to be a lot of other people starting similar companies. But even when I attempt to adjust for price, the hot-round investments still have underperformed.

I asked a few other investors about their experiences, and most are roughly similar. Most of the really big hits never had TechCrunch writing about their super competitive seed round everyone was trying to get in.

Interesting that a 10,000x comment comes from someone who also wrote the above…?

Many thanks to Tom Egan, Edward Coady, and John Lanahan for reading/commenting/contributing to this post.

The Customer Adoption Problem for Health Startups

We can all agree that for today’s internet startups, customer acquisition is one of the biggest issues they face. The world is so crowded with apps, things to do, things to grab your attention and waste time – it’s one of the hardest problems to solve to break through the noise and get someone to notice you AND download you or try you out. Consumer startups face this problem the most, but B2B startups also face this problem. There are enough B2B startups now hitting up the IT managers of companies big and small that they are slowing down in their decision to implement a new product or service. And as I’ve always said, if it takes too long to gain customers and get to sustainable traction or great metrics, you will die because your bank account won’t last that long.

However, there is a similar and IMHO worse problem for today’s health related startups. But it’s not quite a customer acquisition problem – you can spend money to get people to download your app or get to your website – it’s more related to conversion and I call it a customer adoption problem.

First, I want to clarify that when I say health startup for the purposes of this post, I am leaving out the “health” startups which don’t really have definable, definite, repeatable health impact – I would put fitness trackers, GPS watches, workout apps and hardware, etc. into this category. They provide data, but you need to figure out how to use it OR, there really is no definable, definite, repeatable health benefit – by this I mean, you can’t tell someone exactly how many steps you need to take to lose 10 pounds or to prevent a heart attack. It’s just not possible.

I would also leave out the traditional biomedical device startup, whose path is generally not direct to consumer (some are, and more are needing to go to market first before some kind of exit happens), they create a great device, take it through FDA trials to prove efficacy, and then sell to a large biomedical device company. The biomedical device startups who are going direct to consumer, however, can be placed in my category of health startup.

So leaving out those kinds of “health” startups, what are we left with? Some pretty cool startups that are applying technology to solve some really sticky health problems. However, there is a HUGE hurdle towards success – the culture of the consumers highly tilted against adoption of these kinds of products and services.

These hurdles are:

1. People have been trained for decades that they should never pay for their healthcare. Insurance should pay for all of it. If it’s not reimbursed by insurance, they won’t pay for it out of pocket and avoid treatments of any sort that makes them pay.

2. We are in a “curative” culture of healthcare and not a “preventative” one. We would rather wait for something to happen (and lead crappy, self-indulgent, unhealthy lives to get there) and then do something about it.

3. Along with 2., we don’t see the value of something we haven’t experienced yet, or have no experience with. Why should I worry about my thyroid? What the heck is that? My heart beats so why worry ahead of time about it?

4. We hate hearing something might be wrong with us. So any product or service that would tell us that is avoided as well.

5. Inaccurate, outdated information on health hampers the ability of new information, packaged into products and services to gain traction. The illusion of knowledge exists in health; knowledge seems to be eternal but it is not. Every year new information comes out and old information is discarded, but people stubbornly hold onto information they learned years ago and they erroneously think it’s permanent. Still this means that they are resistant to adopt new information or methods due to thinking they already know enough.

As you read through the above, I’m guessing that you can relate to each one of those points. To me, these are nearly unsurmountable issues that are deep rooted in the culture of our society. These are issues that are top of mind for me right now in looking at today’s health startups (by my previous definition). Finding a believable, reliable solution to the customer adoption problem that circumvents these issues is critical to their success, and whether I will invest in them.